Announcements

Drinks

Governance support for Austrian covered bonds now allows for up to six-notch uplift

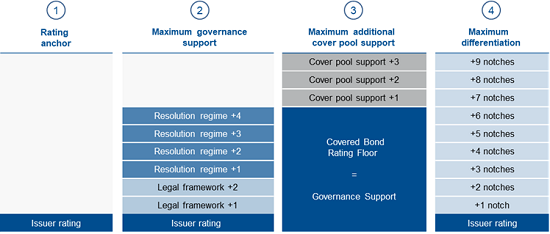

“The governance support assessment in our covered bond methodology provides a floor to how much a covered bond can be rated above its issuer’s rating and constitutes an anchor for additional credit differentiation based on cover pool support,” explained Mathias Pleissner, Scope’s deputy head of covered bonds.

Scope’s view on the two-notch uplift driven by legislative support remains unchanged. “But we now have a more credit-positive view on Austria’s covered bond legal framework, which previously ‘just met’ our expectations,” Pleissner said.

The updated legislation transposes the European Covered Bond Directive into local law. The new framework consolidates the three sets of existing legislation, improves and aligns it more closely with best practice as seen in other covered bond frameworks across Europe.

“We have increased to up to four additional notches (from three) the credit benefit Austrian covered bonds can receive based on analysis of how regulators would maintain the issuer and its covered bonds upon regulatory intervention, the preferential status of covered bonds in a resolution scenario as well as their systemic importance,” said Reber Acar, associate director, covered bonds.

“Issuer and programme-specific considerations can lead to an uplift of up to two notches lower. Austrian covered bonds are excluded from bail-in and we have adjusted our view to ‘moderately high’ systemic importance,” Acar added.

Maximum rating differentiation for Austrian covered bonds

Source: Scope; credit differentiation is expressed as a rating notch above the issuer’s rating

At the end of 2021, the outstanding volume of Austrian covered bonds accounted for more than 20% of the country’s GDP, which puts them into the upper third among European peers. Annual issuance since 2010 has averaged EUR 12bn, peaking at EUR 27bn in 2020 owing to the TLTRO. Currently, 26 banks, comprising all large and most mid-size banks, are covered bond issuers and they are increasingly placing bonds with international investors.

“The long-awaited consolidation of the country’s three sets of covered bond legislation into one, ongoing industry efforts to create a common Austrian covered bond brand and the regular use of public placements by large and mid-size banks has led to stronger visibility. We have also observed stronger cohesiveness among domestic stakeholders,” said Pleissner.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.