Announcements

Drinks

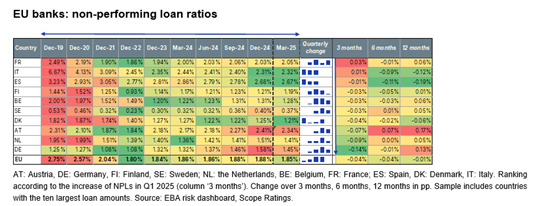

EU banks NPL Heatmaps: asset quality steady but downside pressures emerging

The consolidated NPL ratio remained low and relatively stable at 1.85% in Q1 2025, though, down slightly from 1.88% in Q4 2024, mainly reflecting increased lending in the wake of lower interest rates. “But this stability should be viewed with caution,” said Alvaro Dominguez Alcalde, an analyst in Scope’s financial institutions team. “Banks added roughly EUR 2.6bn of new NPLs in the quarter, increasing the total stock to around EUR 378bn, the second largest since the second quarter of 2022.”

The largest quarterly increases were in France and Italy. Moderate declines were seen in Germany, the Netherlands and Austria. Meanwhile, the gap in asset-quality trends between core and peripheral countries has narrowed.

Corporate NPL ratios remained stable, amounting to approximately 3.4% in Q1 2025, but the trend varies greatly between countries and sectors. While Italy and Denmark saw the largest increases (+8bp each) followed by France and Sweden (+4bp each), banks in many countries saw a decline, notably Germany and Austria (-24bp and -19bp, respectively.

There was a mild deterioration in wholesale and retail trade, construction and some smaller sectors (including agriculture), which together represent less than 30% of the aggregate EU corporate loan portfolio. In other sectors, NPL ratios are stable or decreasing.

Real estate, the largest corporate segment at 25.6% of lending, remains stable from an NPL perspective at 2.8% in Q1 2025. By contrast, the construction sector (about 5% of total corporate lending) saw the sharpest deterioration, rising 20bp to 6.5%, with weakening particularly evident in France (+90bp quarter on-quarter).

The household segment continues to show solid performance: NPL levels remain stable at 2.14%. The most visible improvement was in Denmark (-10bp) but this was offset by signs of mild deterioration in France (+4bp). Household NPL ratios in Denmark, Finland and Germany are declining.

“There was a moderate increase in cost of risk at EU level, although this reflects higher net provisioning in many countries, often driven by management overlays,” Dominguez Alcalde noted.

The share of Stage 2 loans marginally improved to 9.5% in Q1 2025 (vs 9.7% in Q4 2024) The Netherlands and Germany experienced the largest declines (-60bp and -40bp respectively). France was the only country to show a negative development.