Announcements

Drinks

ECB rate hike positive but a complex equation for European banks

By Nicolas Hardy, Deputy Head, Financial Institutions

By Nicolas Hardy, Deputy Head, Financial Institutions

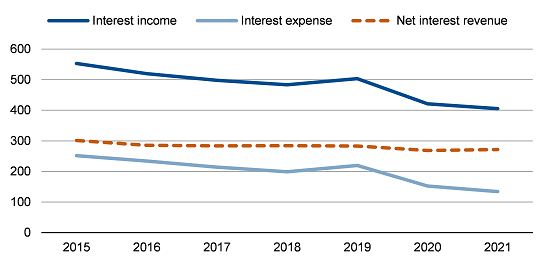

Interest revenue has eroded in recent years due to low-for-long interest rates. Banks have managed to limit the impact of this erosion thanks to a parallel shift in interest expense. Rate hikes are now firmly on the agenda and banks have positioned the duration of their balance-sheets to benefit from repricing. However, banks are not equally positioned to benefit from this movement.

The ECB move is intended to make borrowing more expensive, but also to make savings more attractive. Of note, banks already accumulated excess liquidity during the pandemic thanks to accommodating central bank policies and precautionary customer deposits. The issue of managing excess liabilities will become more urgent if the policy to curb credit demand proves to be successful.

The ECB also wants to ensure that maturing TLTRO drawdowns do ‘not hamper the smooth transmission of monetary policy’ and it will ‘evaluate options for remunerating excess liquidity holdings’. But it remains to be seen if the ECB will be able to prioritise the effectiveness of monetary policy transmission smoothly as support measures are withdrawn.

The introduction of the Transmission Protection Instrument (TPI) may allow for the purchase of private-sector securities. Pending full details, the TPI could work as a backstop mechanism in case of adverse market conditions for the most exposed banks. We expect that this option would only be actioned under very specific circumstances.

Marginally eroding interest revenue reflects banks’ effective balance sheet management (EUR bn)

Aggregated data from a sample of 30 large European banks. Source: SNL, Scope Ratings

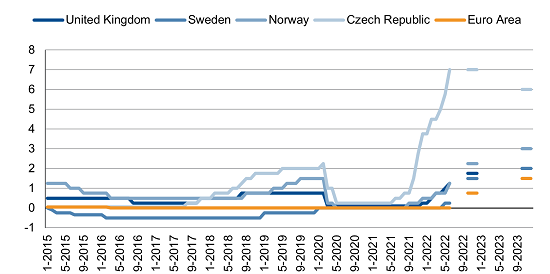

In many countries, central banks have already started to rise policy rates (see Scope’s Sovereign mid-year outlook). European banks with operations in these countries, such as in Norway or the Czech Republic, are benefiting from this early move. In the most competitive markets, though, clients have switched to fixed rates, which will delay the repricing of the back books.

Policy rates in a selection of European countries (2015-2023F)

Source: central banks, Scope Ratings

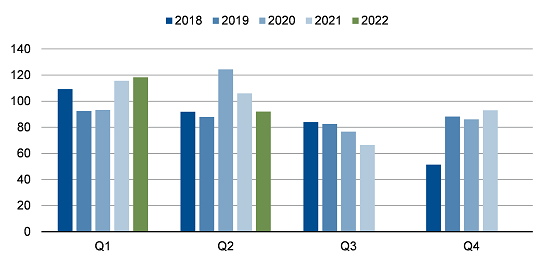

The speed at which deposits are being repriced, or how banks can maintain access to more volatile wholesale markets will also influence banks’ refinancing costs. Credit spreads have widened considerably this year in anticipation of slower economic growth, and issuance volume has slowed. But so far, in aggregate, there are no signs of a credit crunch as banks have continued to raise debt in line with previous years.

European banks’ unsecured debt issuance (EUR bn)

Source: Bloomberg, Scope Ratings estimates.

Rising interest rates will allow investors to better differentiate among creditors via higher risk premiums. Banks will apply risk premiums to their clients but they will also be exposed to them. A flight to quality under more challenging operating conditions could accentuate this development.

The profitability challenge will be compounded by higher operating costs (due to wage increases) and higher cost of risk as tightening financial conditions lead to non-performing loan formation. This explains why bank valuations remain below book value for many European banks.