Announcements

Drinks

Italy: rate hikes, energy crisis drive bank performance amid likely stable post-election politics

By Alessandro Boratti, Analyst, Financial Institutions

By Alessandro Boratti, Analyst, Financial Institutions

A clear win for the centre-right coalition led by Brothers of Italy, sure to have a sizeable but not two-thirds majority in both chambers of parliament, should reduce the risk of near-term political instability by allowing the swift formation of a new government.

Assuming investors take the election outcome in their stride, one focus of attention will be banking profitability, supported in Italy and the rest of the euro area by the ECB’s increased base lending rates, now expected at around 1.5% at the end of the year. The boost for net interest income will be sizeable across the board, even if the scale will depend on banks’ individual business models and balance sheets. The full boost for margins will be felt only in 2023, as loans reprice only gradually.

On the other hand, banks may face rising default rates towards the end of the year. Possible disruptions to gas supplies and still elevated prices might lead to a more significant-than-expected slowdown in industrial production and continue to fuel inflation. With the Italian economy at risk of recession, insolvencies could rise. As a result, Italian banks could be forced to increase loan-loss provisions above average management guidance for the rest of the year (cost of risk of 40bps).

That said, markets will closely monitor the new government’s political agenda, focusing on debt sustainability and relations with EU institutions. We are confident of the continuity in economic policy and pragmatic relations between Rome and Brussels, but any political developments increasing uncertainty on these two issues would trigger further market volatility to which Italian banks are sensitive given their large portfolios of government securities.

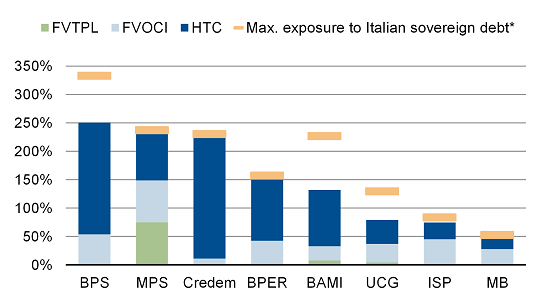

Figure 1: Italian peers: exposure to Italian sovereign debt as of H1 2022

*Maximum exposure to Italian sovereign debt as % of CET1 capital since 2017 (year-end data points)

Source: Company data, Scope Ratings

Investors are keenly aware that, while the ECB has purchased larger amounts of BTPs in its re-investment policy, further support of the central bank isn't certain in view of the conditions attached to the untested Transmission Protection Instrument (TPI).

As of H1 2022, the eight Italian banks in our sample held EUR 125bn of Italian sovereign debt in addition to about EUR 100bn in state-backed loans. Among these institutions, only BP Sondrio, Banco BPM, and UniCredit have materially reduced their BTP exposure (as percentage of CET1 capital) since YE 2017 (Figure 1).

Italy’s banks have rebalanced Italian BTP portfolios

Any short-term spike in Italian government bond yields would affect lenders through three main channels: capital, earnings, and funding, though in each case, we are confident that Italian banks are less vulnerable than they used to be.

Banks’ capital is shielded from volatile domestic bond prices. Following past mark-to-market losses due to BTP-Bund spread widening, lenders have rebalanced Italian BTP portfolio by reducing the proportion held through ‘other comprehensive income’ from 106% of CET1 capital as of YE 2017 to 39% as of June for the banks in our sample. Moreover, compared with previous crises, banks have built up healthier capital buffers which gives them more room to absorb temporary unrealised losses.

When bond prices fall, banks must record unrealised trading losses if they hold securities at fair value through profit and loss (FVTPL). The volume of such securities in the Italian banks’ balance sheet was negligible at the end of June, except for MPS (albeit with low duration). Bank revenues could still be affected by losses on equity portfolios and/or lower sales of asset management products, but these represent minor income drivers on average.

Finally, volatile bond markets could raise funding costs for Italian banks and potentially hamper bond issuance activity. This is because bank wholesale funding costs tend to be highly correlated with sovereign borrowing costs.

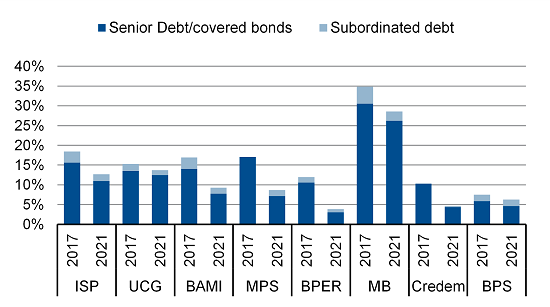

Figure 2: Italian peers: wholesale market funding as % of total* – YE 2017 vs YE 2021

Source: SNL, Scope Ratings

*Total comprises customer, interbank and central bank funding.

AT1s not included

However, after the global financial crisis, Italian banks have progressively reduced their reliance on the bond market for funding. This trend has continued also in the past five years, as illustrated in Figure 2. The main drivers behind such decline were the launch of the ECB’s TLTRO facility and the increase in customer deposit funding, especially during the pandemic.

We don’t expect funding mix to change in the next quarters given the stickiness of customer deposits at the current interest rate level. The first TLTRO III redemptions will also be manageable.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere, including ones for Banco BPM SpA, Credito Emiliano SpA, Intesa Sanpaolo SpA, UniCredit SpA, Mediobanca SpA.