Announcements

Drinks

France: government's reform credentials, long-term fiscal resilience hinge on pensions overhaul

.jpg) Thomas Gillet, Associate Director, Sovereign and Public Sector Ratings

Thomas Gillet, Associate Director, Sovereign and Public Sector Ratings

Rising interest rates and tighter expected ECB monetary policy are more important drivers of government spending in France (AA/Stable) in the coming years than pension deficits.

To be sure, public debt-to-GDP would likely increase by about 2.5 to 3.0 percentage points by 2030, should France’s National Assembly fail to approve the reform or the government withdraw the reform in face of trade union opposition. The increase would be an impediment to the objective of President Emmanuel Macron’s government to lower debt-to-GDP ratio, which the government aims to modestly reduce to 110.9% in 2027 from 111.2% in 2023.

French government’s fiscal targets are at risk from growing pension deficits

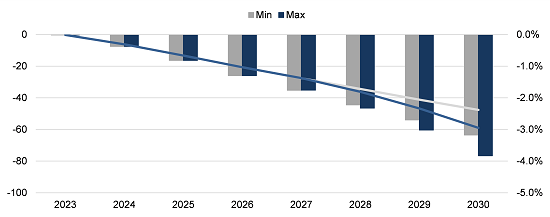

EUR bn (LHS), % of GDP (RHS)

Note: cumulative deficit of the pension system based on extreme scenarios – upside (min) and downside (max) – as published by the Conseil d’Orientation des Retraites in September 2022.

Source: Conseil d’Orientation des Retraites, Scope Ratings

Reform offers clear but modest benefits for public finances

The consequences of not undertaking the reform would be more significant in the longer term, by adding up to EUR 500bn of public debt (about 20 points of current GDP) over 25 years according to government estimates. This is of some concern for the outlook for France’s public debt whose broadly stable rather than declining trajectory is increasingly divergent from other large western European economies.

Progressive rebalancing of the pension system would help restore fiscal buffers, either for long term public investment or to accommodate future shocks, by generating fiscal gains of up to EUR 18bn by 2030 according to the government.

However, in the absence of reform, cumulative deficits of the pension system, between EUR 60bn and EUR 80bn by 2030, would still be modest compared with debt issued in response to Covid-19 (EUR 165bn) and energy mitigation measures (c. EUR 100bn).

Refinancing deficits from the pension system would cost EUR 7bn to 8bn by 2030 (or about 0.3% of GDP) based on the government’s projections of 10-year interest rates, which is significantly lower than the cumulative rise in the interest burden triggered by higher rates, estimated between EUR 60bn and 90bn by 2027.

Pension changes would send a strong signal on reform momentum

We recognize that the pension reform is not only about helping the government better balance its books in the short and long term.

Passing the pension reform in parliament, with support of the opposition party Les Républicains, would demonstrate Macron’s ability to deliver on a major structural reform despite the loss of an absolute majority in last year’s legislative elections. This would complement other supply-side policies, including the reform of the unemployment benefit system.

Social acceptability to remain the last hurdle despite proposed sweeteners

The government’s proposal includes several mitigating measures aimed at reducing the impact of the reform on low-wage earners – including a revaluation of the minimum level of pensions and exemptions for workers who entered the job market early.

Still, the extension of the retirement age to 64 and the gradual phase out of the special regimes remain highly contentious, which could exacerbate social tensions and lead to large-scale mobilisation against the reform, with a day of protests planned for 19th January.

Mass protests would revive tensions observed during the yellow vest protests and in public debates around wealth inequality and taxation. This may complicate alternative routes for the government who holds only a relative majority in parliament to fund the deficit of the pension system and challenge the government’s fiscal consolidation strategy that would be needed if the pension reform fails.

Thibault Vasse, Associate Director, and Brian Marly, Analyst, contributed to this commentary.