Announcements

Drinks

Europe’s hybrid bond market: issuance set for 2023 comeback on refinancing demand, rating concerns

Eurofins Scientific SA, the French testing firm which last year chose to refinance a hybrid with a senior bond last year, has tellingly returned to the market with a EUR 600m issues, paying a 6.75% coupon. Also quick to market this year are three European utilities: Italy’s Enel SpA, with EUR1.75 bn issue in two tranches; Energias de Portugal SA and Iberdrola SA have each issued a EUR 1bn green hybrid.

“Europe’s hybrid corporate bond market should return to growth in 2023, driven by refinancing, after a dramatic slump last year when rising interest rates and worsening economic prospects deterred companies from tapping the market,” says Azza Chammem, senior analyst at Scope ratings.

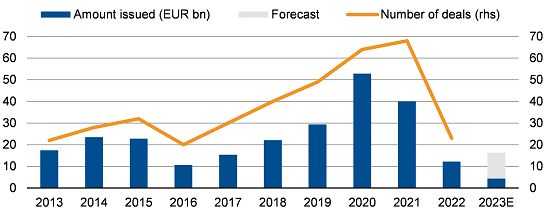

Issuance should rebound to at least EUR15 billion from last year’s EUR 12bn, the lowest level since 2017 and a steep drop from the EUR 40bn issued in 2021.

Lost appetite? European corporate hybrid bond issuance 2013-2023E

Source: Bloomberg, Scope

Equity weighting in hybrid issuance to drive deals in 2023

“To be sure, hybrid coupon rates are likely to remain high this year which will continue to deter interest-rate sensitive issuers such as real-estate companies. Some issuers will be tempted to skip initial calls because the step-up coupon is below the cost of replacement borrowing, though that may disappoint investors who might demand a higher premium in future to reflect extension risk,” says Chammem.

“Even a subdued recovery in hybrid deals this year from non-financial companies would underline the segment’s emergence as a still small but increasingly important part of Europe’s capital markets, particularly for capital-intensive business such as utilities and telecommunications companies,” she says.

The partial equity component of hybrid bonds ensures they remain an attractive way to raise funds without impairing credit metrics and triggering credit rating downgrades.

Europe’s capital-intensive investment-grade companies, the typical issuers of hybrids given their sufficiently strong, predictable cashflows, will be able to absorb rising interest costs this year, though inflation and slowing earnings growth will present more of a challenge as the tailwind of the post-pandemic recover fades. Hybrid bonds will also remain an option for companies financing large acquisitions.

Register here for our 8 February webinar Outlook for European bank and corporate hybrids: refinancing and rating concerns drive issuance in 2023.