Announcements

Drinks

France: pension reform to spur medium-term fiscal gain at governance cost

.jpg) By Thomas Gillet, Associate Director, Sovereign Ratings

By Thomas Gillet, Associate Director, Sovereign Ratings

France’s (AA/Stable) pension reform, centred on prolonging the age of retirement to 64 from 62, should ensure the progressive rebalancing of the pension system by 2030 given unfavourable demographic trends and a widening deficit. The reform sends a strong signal to European partners and international institutions of France’s intent to preserve medium-term fiscal sustainability and introduce supply-side reforms.

Still, the fiscal dividends from the reform will be lower than expected. The reform aims to generate EUR 18bn in annual cost savings by 2030 but falls short of President Emmanuel Macron’s election pledges because the government agreed to water down the legislation in the hope of securing the parliamentary support of the conservative opposition party, Les Républicains.

Most of Les Républicains agreed on a pension reform they historically supported but growing dissension within the party has made a parliamentary vote too uncertain to be called.

Unable to count on Les Républicains, Macron’s government had to sidestep a vote in the National Assembly to pass his pension bill, which leaves more limited room for manoeuvre to advance his reform agenda and scale up long-term investment spending.

Passing the legislation by force, while far from uncommon under France’s Fifth Republic, raises the risks of further political fragmentation, given the current presidential party’s lack of an absolute majority in parliament where far-right and far-left parties have an unprecedented presence.

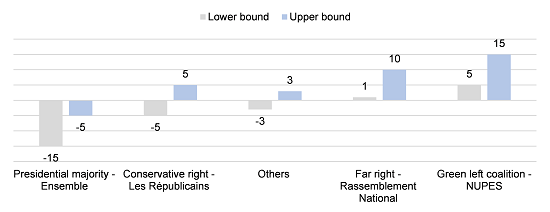

Figure 1: Macron’s party would lose seats in parliament in case of early election

Number of seats, change in comparison to June 2022 legislative election

Source: Toluna Harris Interactive pour Challenges. Scope Ratings

Structural reform momentum likely to slow

Macron’s government survived no confidence votes called for by the opposition following the pension reform as Les Républicains to date have mostly refused to join forces with the far right or green-left coalition. Macron is thus unlikely to dissolve parliament and call new elections given his Ensemble party’s lack of popularity.

Instead, a cabinet reshuffle, including the appointment of a new prime minister, is the most likely option to breathe new life into the government. In the meantime, protests, such as strikes by public-sector staff, are likely to continue.

Even in a worst-case scenario for the government of having to backtrack on the reform, it is worth noting that the pension question is far from the most important determinant of the country’s fiscal outlook despite a cumulative deficit forecasted at EUR 60bn to EUR 80bn by 2030.

Pension deficit only one of many pressures on state finances

For example, the interest payments, rising due to tighter ECB monetary policy, will likely range from EUR 60bn to EUR 90bn in 2027. The pension deficit is also small compared with the cost of measures introduced in response to the pandemic (EUR 165bn) and the energy shock (around EUR 100bn), as well as President Macron’s commitments to invest more in nuclear power (EUR 50bn) and defence (EUR 100bn by 2030).

It will require more than a new prime minister to energise President Marcon’s reform plans. The government is in danger of facing legislative gridlock in any fresh efforts to boost France’s growth potential and further stabilise public finances, which would help Macron take a lead in determining policy at the EU level.

Durably weaker reform momentum, the unfavourable economic outlook and sustained pressure on public finances each exerts downside pressure on France’s credit ratings. Scope’s next review is on 26 May 2023.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.