Announcements

Drinks

Asset-quality review: falling NPL ratios hide rising vulnerabilities

“Cost of risk is at historic lows and strong profitability can absorb higher credit losses. The positive effect of rising interest rates and loan repricing has supported banks’ pre-provision income so far,” said Marco Troiano, Scope’s Head of Financial Institutions. “The challenge for 2023 and 2024 is to balance the need to maintain sound provisioning against deteriorating credit while continuing to show positive bottom-line performance.”

While headline corporate insolvencies remain stable, vulnerable sectors such as accommodation and food, transportation, education and healthcare saw a quarter-on-quarter doubling of bankruptcies in the fourth quarter of 2022. CRE loans represent an additional area of vulnerability, owing to a trifecta of high rates, rising construction costs and a softening outlook for property prices.

“Even though the economic outlook for most EU countries is weak, resilient labour markets have supported household employment so far, while the shift in recent years towards more fixed-rate mortgage lending has provided a cushion against the immediate impact of higher rates,” said Carola Saldias, Senior Director in Scope’s financial institutions team. “But even with these supporting factors, the sustained erosion of real disposable household income and savings together with the doubling of euro area borrowing costs year on year weaken debt-servicing capacity, particularly in countries where household debt is high.”

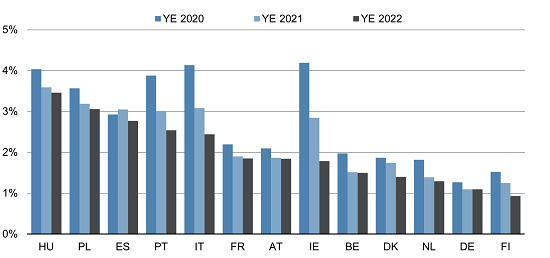

Rising NPLs this year and beyond will reverse the trend of the past decade, which has seen euro area banks significantly reduce bad loan stocks through securitisations and asset disposals. At the end of 2022, NPLs stocks of EUR 357bn were at their lowest since the ECB started publishing NPL data in 2015.

Non-performing loan ratio (%) by country: 2020-2022

Source: EBA Risk Dashboard, Scope Ratings

“For 2023, we expect headwinds in all types of loan portfolios”, Saldias highlighted. “They may take some time to show up in headline asset-quality ratios but early signs of deterioration are already visible in faster-moving asset-quality metrics such as Stage 2 loan classifications under IFRS 9”.

Scope sees greater risks for corporate and SME loans. “The increase in interest rates has turned refinancing conditions via capital markets more challenging, which could drive companies to substitute bond issuance with bank loans, which could lead to an increase in lower-quality loans if banks fail to capture the potential of higher credit risk,” Troiano cautioned. “SMEs look particularly vulnerable. Many had been supported by generous public-sector financing guarantees and other measures but now they are confronted by much tighter lending standards and much higher refinancing rates.”

Banks’ exposure to commercial real estate is another key vulnerability. This levered, cyclical sector is facing a trifecta of headwinds: soft real estate price dynamics, increasing construction costs and tight refinancing conditions. In terms of aggregated exposure to real estate activities and construction, countries like Sweden, Denmark, Austria, France and Germany show concentrations above 30% of their total non-financial corporate exposures, which could represent a material source of asset-quality deterioration under a scenario of steadily increasing interest rates.

Download the Asset-quality Review here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.