Announcements

Drinks

Italian Bank Quarterly: strong stress-test results, H1 performance provide reassurance

“On the back of remarkable first-half results, the banks have confirmed or upgraded their upbeat guidance for FY 2025 results, supported by resilient net interest income, growing fees, costs under control, and no signs of material asset-quality deterioration,” said Alessandro Boratti, lead analyst for Italian banks.

Our sample of eight Italian banks (Intesa, UniCredit, BPM, MPS, BPER, Mediobanca, Credem, BPSO) posted a return on average equity of 16.1% in the second quarter, compared to 15.7% in Q1 and 15.6% in Q2 2024.

The stable outlooks on our public ratings – UniCredit (A/Stable), Intesa (A/Stable), and Banca Popolare di Sondrio (BBB+/Stable) – indicate that risks are broadly balanced in 2025.

“But while Italian banks have exceeded our expectations to-date, we are projecting weaker results in the second half as lower rates eat into interest margins,” Boratti cautioned. “We also anticipate higher cost of risk, particularly if banks increase loan-loss provisions in anticipation of a deteriorating economic outlook.”

On asset quality, we do expect some minor deterioration, even if loan default rates remain at record lows of around 1%. “Because the exposures of large Italian banks to the sectors most vulnerable to US levies is limited, impacts on asset quality will be manageable,” Boratti noted.

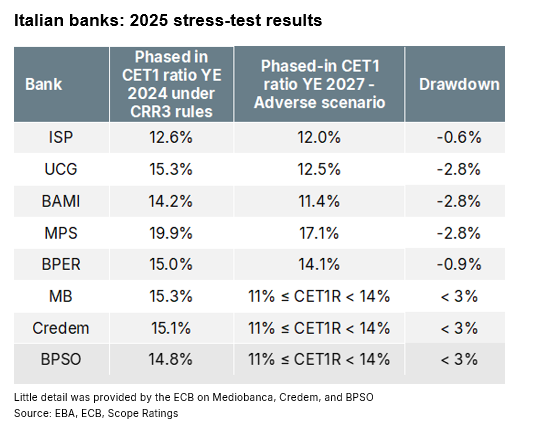

Backed by strong profitability and clean balance sheets, Italian banks’ stress test results were sound. Capital ratios remain above minimum requirements for all lenders in our sample. Under the severe scenario, the capital drawdown between YE 2024 and YE 2027 would average 180bp, significantly lower than c. 400bp in the 2023 stress test. Results also compare favourably with the average for EU average (c. 400bp for the banks in both the ECB and EBA sample). “Capital losses can be absorbed by the banks’ capital buffers without MDA breaches,” Boratti said. The average CET1 ratio for the banks in our sample stood at 15.6% at the end of the second quarter.

Following UniCredit’s withdrawal of its Banco BPM takeover bid, BPM is once again at the heart of the debate about consolidation among Italy’s mid-tier banks and can still play an important role in domestic M&A. Having walked away from a potential deal with MPS during the pandemic, UniCredit has missed out on another opportunity to consolidate its position as Italy's second largest banking group and challenge Intesa's leadership. “But we view UniCredit’s actions as evidence of a disciplined M&A strategy focused on risk-adjusted returns and long-term value creation for shareholders,” Boratti said.

Shortly before UniCredit announced its takeover bid in November 2024, BPM purchased a 5% stake in MPS (and increased it to 9%), positioning itself as a potential MPS acquirer. Crédit Agricole could be a natural takeover candidate for BPM. The French group has a 19.8% stake and filed a request with the ECB in July for authorisation to increase it to over 20% (although it currently intends to keep its stake below the mandatory takeover threshold of 30%).

“Execution risks, including a potential political backlash, must be considered alongside financial and industrial factors in the event of a potential takeover offer,” Boratti warned.

Download the Italian bank quarterly here.

See also:

Updated rating report on Intesa, July 2025

Scope upgrades Banca Popolare di Sondrio’s issuer rating to BBB+, revises Outlook to Stable, July 2025

Scope affirms and publishes UniCredit’s A issuer rating with Stable Outlook, December 2024