Announcements

Drinks

Italy: recovery plan is falling short in boosting growth amid still resilient economy

By Alvise Lennkh-Yunus and Alessandra Poli, Sovereign and Public Sector

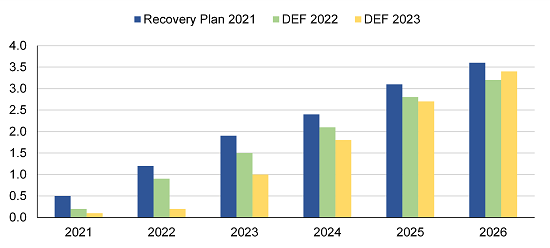

The Italian government has revised its estimates for the macro-economic impact of the post-Covid 2021-26 recovery and resilience plan (RRF). The plan increased GDP in 2021 by only 0.1pp and a further 0.2pp in 2022, below the government’s original projections of 0.5pp in 2021 and 1.2pp in 2022.

Thus, while the government still expects the cumulative additional impact on GDP by 2026 at 3.4pp – slightly above the 3.2pp estimate made in 2022 and above the national fiscal council’s estimate of 2.8pp in a high investment efficiency scenario, but below the original projection of 3.6pp (Figure 1) – the impact is significantly delayed. In fact, the government expects a full 1.6pp of additional growth in 2025-26 only, up from the 1.1pp estimated previously.

We remain cautious, however, on Italy’s growth outlook even if the full implementation of the recovery plan could provide some upside potential. The 3.7% growth recorded in 2022 was driven by private consumption, investments, particularly in construction, and the government’s fiscal measures to counter the negative effects of high inflation on households and businesses.

Looking ahead, these growth drivers will either reverse, as is the case with the phasing out of bonuses for renovation and energy efficiency such as the “Superbonus,” or be adversely affected by tighter monetary policy and the government’s fiscal consolidation. We expect a gradual slowdown in Italy’s real GDP growth to around 1.2% in 2023 and 0.8% in 2024.

The full absorption of EU funds is thus critical to drive economic growth via public investment in the near-term – which should average 3.5% of GDP over 2023-26 compared with 2.3% in 2015-19 – while the implementation of reforms is key to raise Italy’s growth potential, which we estimate at around 1%.

Figure 1. Annual macroeconomic impact of Recovery and Resilience Plan, 2021-26

GDP percentage points

Source: Ministry of Finance, Documento di Economia e Finanza (DEF) 2023, Scope Ratings

A mix of exogenous and structural factors challenges the implementation of the recovery plan

The macro-economic environment for all European countries has worsened from two years ago when post-pandemic recovery plans were first agreed: rising energy and commodity prices, together with persistent global supply-chain bottlenecks, have led to higher construction costs and are constraining the capacity of government and companies to implement projects.

However, implementation of Italy’s recovery plan is also hindered by the country’s structural weaknesses. These include persistent labour market challenges, including demand and supply mismatches and a shrinking working-age population linked to a falling birth rate, which have resulted in widespread skill and labour shortages. The problem is particularly acute in construction and sectors related to energy and the digital transition, which are at the core of the recovery plan.

Skill shortages are also evident in public administration, where difficulties in recruiting skilled workers, alongside inefficiencies in IT systems to report and track project data, are causing blockages in implementing and monitoring projects. The resulting spending delays threaten to hold back the full absorption of allocated funds and limit their contribution to economic growth in the medium term.

Next Generation EU funds spent by end-2022 amounted to EUR 24.5bn compared with the government’s EUR 47.2bn estimate in 2021, according to the latest Court of Audit report. During the first four months of 2023, spending for recovery funds totalled only EUR 1.2bn, highlighting the slow pace in deploying resources. This makes the initial expectations of spending close to EUR 90bn (DEF 2021) during the period 2020-23 impossible to achieve.

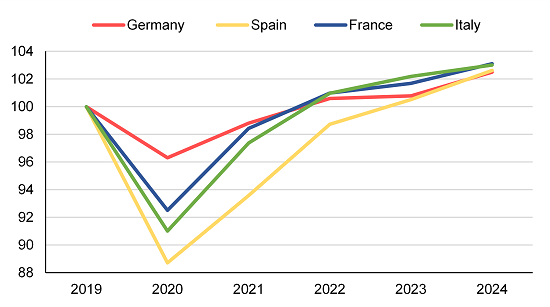

Figure 2. Real GDP growth rate for Italy, Germany, France and Spain, 2019-2024F

Indexed real GDP growth rates, 2019=100

Source: Eurostat, Scope Ratings

A revision of the national recovery plan, currently under discussion with the European Commission ahead of a 31 August deadline, could help Italy overcome some of the bottlenecks in the next four years and optimise the allocation of resources. It is also the opportunity to ensure selected projects are indeed growth-enhancing, which is critical as EU loans, set to amount to EUR 122.6bn, will have to be repaid.

The supply-side reforms of the plan – including the justice and competition reforms as well as the reform and simplification of the public administration – could also support economic growth in the medium term.

While the economic impact from the recovery plan has been underwhelming so far, Italy has shown its economic resilience in recent years by outperforming other large euro area economies (Figure 2). This is remarkable given the country’s large dependence on Russian gas imports, which accounted for 43% of total energy imports in 2021. In one year, Italy reduced the share of Russian gas in its energy mix by more than half, further diversifying its energy imports, increasing the use of renewables and alternative fuels, as well as reducing industrial and domestic consumption.