Announcements

Drinks

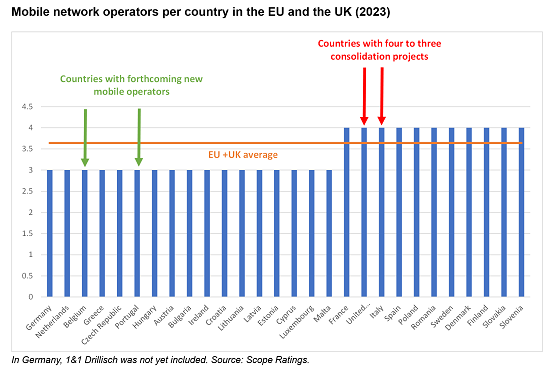

Mobile consolidation in Europe: still a very long road

“Domestic mergers between fixed-mobile operators are already difficult as there are no more cable operator targets available while cross-border telecoms acquisitions offer no real synergies,” said Jacques de Greling, a director in Scope’s corporate ratings team. “We consider that sector M&A risk, with the associated increase in leverage, remains limited from a credit point of view.”

The ECJ ruled on July 13 that the EU General Court must re-judge Hutchison’s 2016 appeal of the European Commission’s veto of the proposed merger between two British mobile operators – Hutchison’s Three and O2 (Telefonica) – saying that it was too demanding on standards of proof. The proposed merger would have reduced the number of operators in the UK from four to three. We do not expect the General Court to reach its final decision until summer 2024 at the very earliest but probably later.

The Commission is still reviewing the four-to-three mobile merger in Spain (Orange Spain and MasMovil). As expected, the case is under Phase 2 review as the Commission encountered some serious doubts on June 27. The EC fears that the project might lead to significant price increases in the Spanish retail mobile market as well as the fixed internet market and multiple-play bundles. It has until September 4 to provide its final answer but as there will be some negotiation on remedies, the answer will likely be published weeks or months later.

In two EU countries with only three mobile operators, Portugal and Belgium, new mobile operators will be launched following 5G auctions as both countries have a long history of calls from national regulators, consumer groups and political power to introduce more competition into their mobile markets.

In the UK, a four-to-three mobile operator merger was announced in June 2023 (Vodafone and Hutchison). “Since the UK is no longer part of the EU, the case will be reviewed the Competition and Markets Authority, which some expect will be less demanding than the European Commission although we believe that this assumption is risky,” said de Greling.

Download the full report here.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.