Announcements

Drinks

Hamas attacks test Israel’s economic resilience; adds risk to regional stability, global growth

Palestinian group Hamas’s attacks on Israel underscore how geopolitical conflict has created extra uncertainty in the outlook for sovereign creditworthiness since Russia’s full-scale invasion of Ukraine in February 2022. This comes at a vulnerable time for the global economy as central banks have tightened significantly to keep inflation under control and public finances are already stretched.

The worsening of the Israel-Gaza conflict has led to sharp falls in the value of the shekel and Israel’s government bonds for which local yields have risen to their highest level since 2012 (Figure 1).

Figure 1. Israel’s government yield surged to 10-year highs

%

Note: Government Benchmarks, 10 Year, Yield. Source: Macrobond, Scope Ratings.

Israel can manage immediate surge in financial volatility

Capital market financing remains no concern, as Israel has diversified funding sources and a lengthy debt maturity, with a US debt guarantee programme acting as a further back-up. The Bank of Israel has also a sound record of currency management and announced a programme to sell up to USD 30bn of foreign exchange reserves to support the shekel.

Those measures are unlikely to challenge reserve adequacy thanks to Israel’s strong balance of payments position. International reserves amounted to more than USD 200bn as of end-August 2023, or more than one year of imports and 125% of gross external debt. This large reserve stock from high current account surpluses (3.7% of GDP in 2022) reduces the country’s vulnerability to economic and financial shocks.

Hamas attacks coincide with turbulent domestic politics

However, the new stage in the Israeli-Palestinian conflict clouds Israel’s growth and fiscal outlooks at a time of turbulent domestic politics, which the Hamas attacks may further unsettle.

After a fiscal surplus of 0.6% of GDP in 2022, Israel’s budget is increasingly stretched following spending allocations to ultra-orthodox and pro-settler parties. The renewed conflict could further widen the fiscal deficit above 2.0% of GDP over the coming years, although public debt remains moderate at 61% of GDP in 2022.

Important parts of Israel’s economy are vulnerable to conflict-related disruption for business, such as the high-tech sector, responsible for around 17% of GDP, and tourism. Instability could also discourage foreign direct investment (about USD 28bn in 2022), particularly into the gas sector.

Furthermore, this situation compounds the ongoing challenge posed by a track record of domestic political instability and contentious policy making including most recently the judicial system reform, which has intensified socio-political tensions.

Uncertainty over knock-on effects on oil markets, inflation and growth

The return of the Israeli-Palestinian conflict to the centre of Middle Eastern politics raises concerns about the potential for a longer-term impact on oil prices.

The heightened geopolitical tensions may furthermore hinder the possibility of diplomatic normalisation between Saudi Arabia and Israel. Such an historic agreement could potentially be viewed as a big foreign-policy win for US President Joseph Biden, ahead of next year’s elections.

There is also a risk that the Israel-Gaza conflict could spill over to other parts of the Middle East, as Iran is the main sponsor of Hamas and Hezbollah, the latter its Islamist ally in Lebanon.

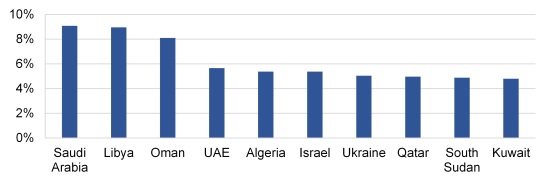

More broadly, oil-producing countries in the Middle East and North Africa are among the world’s heaviest spenders on arms relative to their economic output (Figure 2) amid several unresolved civil wars – in Libya, Sudan, Syria and Yemen.

Figure 2. Middle East, North African states rank among top-10 most militarised

Military spending, % GDP (top-10 highest spending countries globally)

Note: Military expenditure by country as a percentage of gross domestic product, 2010-2022 average; estimates from the Stockholm International Peace Research Institute (SIPRI). Source: SIPRI, Scope Ratings.

In an adverse scenario in which an escalation of the Israel-Palestinian conflict to the regional level results in oil prices sustainably crossing USD 100 a barrel – compared with Brent crude currently trading around USD 88/barrel – concerns about the global outlook for inflation and the response by central banks would grow. This could have negative repercussions for economic growth and sovereign ratings beyond Israel in the medium term.

For now, the most immediate credit risks for sovereigns publicly rated by Scope are Egypt (B-/Negative Outlook), which is under heavy strains and shares a short border with Hamas-controlled Gaza, as well as Cyprus (BBB/Stable), which depends on Israel for oil and gas supplies. Türkiye (foreign-currency rating: B-/Negative) may on the other hand see its regional influence grow as it seeks to promote stability, similar to its role in the context of Russia’s war in Ukraine.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.