Announcements

Drinks

Navigating China’s economic challenges: a difficult task for the PBOC

Q&A with Dennis Shen, Chair, Scope Macroeconomic Council

When People’s Bank of China (PBOC) governor Pan Gongsheng outlined plans for a more accommodative monetary policy last September, he sparked a market rally. His decisive stance earned him the nickname of "China's Greenspan", a reference to former US Federal Reserve chairman Alan Greenspan, who famously slashed interest rates to stimulate economic growth.

Fast forward several months and the PBOC’s capacity to influence market expectations appears to be diminishing as the central bank faces the complex challenge of supporting economic activities through lower borrowing costs while stabilising the yuan to preserve market confidence. These at-times conflicting priorities are testing the central bank’s capacity to maintain the same degree of effectiveness.

Would you agree with those who have nick named the PBOC governor China's Greenspan?

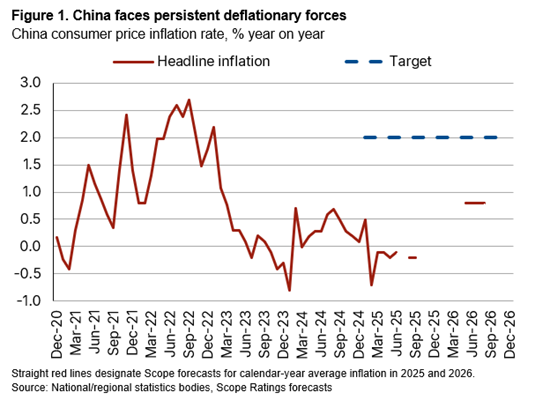

Comparisons to Alan Greenspan may be premature. Greenspan presided over the Great Moderation, overseeing comparatively-robust and stable growth and achieving moderate levels of inflation. By contrast, Pan took office in 2023 amid a structural economic slowdown and the longest run of deflationary forces since the 1960s (Figure 1).

Deflation risk derives from the structural transitions in China’s economic growth model so are not of the PBOC governor’s design. But as the governor brings to China some of the innovations of advanced economy central banks to deal with deflation, including large-scale asset purchases, he has to deliver results that stabilise China’s economy before any comparison with Greenspan can be justified.

The governor has delivered some policy easing to support the economy, countering low inflation and pursuing stabilisation of the embattled property sector. But very high and rising levels of public sector and corporate debt have created a real dilemma for the central bank. It cannot set about overly aggressive monetary easing without material concerns about creating asset-price bubbles and excess debt accumulation. If the governor can solve this apparent policy paradox and help pave the economy’s path to lower but better-quality economic growth and stable debt, he might one day have a seat on the pantheon of central bankers.

What are your thoughts about China's bond rally?

The PBOC is facing a relatively new challenge: increasing evidence of Japanification in the Chinese economy, i.e. very low inflation. Bearing in mind the global inflationary forces in play since 2021, China’s grappling with unusually low inflation highlights the severity of domestic deflationary factors.

This context has seen Chinese 10-year bond yields fall rapidly to near-record lows. The PBOC’s response is complicated by the fact that deflation has not been persistent for more than a half century and also because the tools China is introducing are novel and untested – in China.

Easing monetary policy while reining in market tendencies to price in the most severe economic scenarios has seen a comparatively inconsistent policy mix that has seen an intermittent bond-purchasing programme; on-again, off-again rate reductions; and occasional draconian policies such as the disciplining of certain regional banks for purchasing too many government bonds.

How are the PBOC's actions affecting foreign investor sentiment?

On one hand, ultra-low Chinese yields, a flattening yield curve and ongoing depreciation pressures on the renminbi are understandably alarming. Authorities are wary, as the one ending to the decades of the Chinese economic miracle they are keen to sidestep is any comparison with Japan’s experience of recent decades: low nominal growth, low or negative yields and a weak currency. The PBOC wants its monetary policies to be correctly transmitted and to avoid monetary easing stretching much beyond what it has been announcing.

On the other hand, even if monetary easing has run faster than planned, low yields may be welcome. Given the record levels of public debt and outstanding budgetary challenges, low rates could partially alleviate the challenging fiscal trajectory and support economic restructuring, thereby facilitating the sought-after soft landing. Plus, a weaker renminbi helps combat low inflation, so the low yields achieved via monetary easing, accelerating credit growth and ultimately depreciating the currency might prove strategically beneficial.

Nevertheless, the PBOC’s erratic easing announcements followed by tightening complicate policy signalling. A clearer communication strategy is needed as China transitions from opaque policymaking to greater transparency and market engagement. Foreign investors have been comparatively unphased by the PBOC interventions to date as real rates have stayed attractive and bond prices remain high. Global investors are accustomed to interventionist policies like QE so are unlikely to exit unless they are faced with direct capital restrictions.

Balancing the US dollar-yuan exchange rate using monetary tools looks challenging. What is your observation of and outlook on the PBOC's moves?

The PBOC is navigating a structurally slowing economy facing deflation threats while endeavouring to avoid asset bubbles and rising debt risks, even though growth came in better than economists had anticipated at 5.2% year-on-year in the last quarter. China is seeking to liberalise its capital markets but the PBOC is not accustomed to markets doing so much of the easing for it so it is rightly seeking to prevent monetary conditions from easing too quickly or by too much.

In this context, the PBOC is targeting a guided and gradual loosening of monetary conditions through interest-rate cuts, balance-sheet policies and the currency. Strengthening communication following the example of developed market central banks could help temper market volatility and strengthen credibility.

The Scope Macroeconomic Council brings together credit opinions from ratings teams across multiple issuer classes: sovereign and public sector, financial institutions, corporates, structured finance and project finance.