Announcements

Drinks

European Bank Capital Quarterly

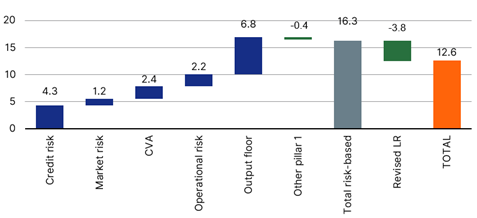

European banks need an additional EUR 600m in Tier 1 capital (EUR 1.1bn in total capital) to meet final Basel III reforms in 2028, according to the EBA’s latest monitoring exercise. The weighted average increase in the minimum Tier 1 capital requirement was 12.6% across all banks, primarily due to the output floor and credit risk capital requirements.

“Including EU-specific adjustments that are not part of the pure Basel III framework, the increase in the minimum Tier 1 capital requirement would be reduced by 3.6pp to 9%,” said Pauline Lambert, executive director in Scope’s financial institutions team. “These adjustments include the supporting factors for SMEs and infrastructure, transitional arrangements for the output floor related to unrated corporates and residential real estate, and the phase-in period for the calibration of the output floor.”

But when Pillar 2 requirements and EU specific buffers are also considered (O-SII, systemic risk, countercyclical), the increase in the minimum Tier 1 capital requirement is estimated at 9.9% for all EU banks and 14.7% for EU G-SIIs. “The total capital shortfall is EUR 1.08bn, very similar to the shortfall under the pure Basel III scenario,” Lambert noted.

Drivers for increase in minimum Tier 1 capital requirement under pure Basel III scenario (%)

Source: EBA, Scope Ratings

The Bank of England has postponed Basel III implementation by six months to 1 July 2025, but the transition period will be reduced to 4.5 years, meaning full implementation by 1 January 2030. “We can expect near-final policies on market risk, credit valuation adjustment risk, counterparty credit risk and operational risk in Q4 2023 while those on credit risk, the output floor, and reporting and disclosure requirements are planned for Q2 2024,” Lambert said. The UK’s implementation date is now aligned with the current US timeline although US authorities are proposing full implementation by 1 July 2028.

“On CRR and CRD, policymakers reached provisional agreement this summer on a number of topics,” Lambert said. “They agreed that the output floor will apply at entity level, there will be further proportionality in the rules for small and non-complex institutions, an agreement that ESG risks be taken in account when assessing the value of collateral, and minimum requirements for branches of third-country banks and supervision of their activities in the EU will be harmonised.”

Implementation is planned for 1 January 2025, but given the delay announced by the UK, there could be some slippage to allow for alignment.

Download the Capital Quarterly here.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.