Announcements

Drinks

Automotive outlook 2024: manufacturers’ credit prospects stable even as trading conditions worsen

By Georges Dieng, Director, Corporate Ratings

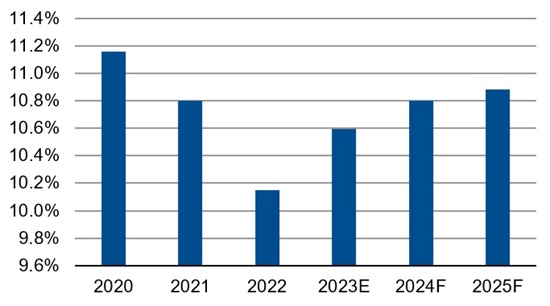

The industry can fund the substantial investments needed for its transformation towards low- and zero-emission vehicles – primarily the shift from internal combustion engines (ICEs) to electric vehicles (EVs) – due to the companies’ ample financial flexibility. Robust liquidity and prudent financial policies characterise the industry’s credit profile. We expect bond issuers in the sector to maintain comfortable credit metrics.

Slower top line growth amid price competition, less favourable product mix

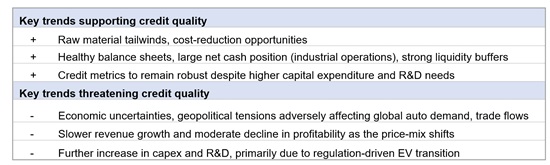

Global vehicle sales are expected to grow at a pedestrian pace of around 2% in 2024, amid macroeconomic uncertainties, geopolitical tensions including potential trade disruptions, tight credit conditions and still-soft consumer confidence. This is in contrast with the rebound of around 9% in 2023, courtesy of the elimination of lingering supply-chain bottlenecks, which helped manufacturers to deliver on their long order backlogs.

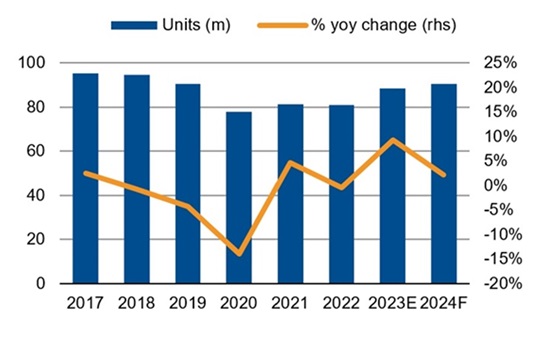

For automotive manufacturers, top-line growth will weaken in 2024 to an estimated 2.8% from 11% on average in 2021-2023 as the main revenue drivers of the past few years fade. Consumer demand is softening, visible in the slowdown in quarterly order intakes. The product mix is normalising after a long period in which it was tilted toward higher-margin vehicles as manufacturers took advantage of the gap between supply, limited by supply-chain constraints, and robust pent-up post-pandemic demand.

As the auto market moves from supply-led to demand-driven performance, pricing reflects this shift from a seller’s market to a buyer’s market in becoming more competitive. Incentives are on the rise again and prices are softening after three years of an unusually tight supply-demand balance, which had lifted net prices to unexpectedly high levels. Price competition is the toughest in the EV segment.

Several automotive players insist that they are maintaining disciplined pricing through “value or volume” strategies, but competition on prices will be difficult to avoid completely given the risk of losing market share. In this context, premium manufacturers, notably Mercedes-Benz Group due to its move upmarket into the luxury segment, will be more resilient than mass-market manufacturers, which will be forced to improve cost competitiveness, illustrated by recent potentially far-reaching measures announced by the Volkswagen brand.

Figure 1: Global light vehicle sales history and forecasts

Sources: LMC Automotive, GlobalData, Scope Ratings (estimates)

Moderate decline in profitability after strong post-Covid margin recovery

We forecast a moderate decline in the sector’s profitability from historically high levels. Raw materials costs are starting to ease and turn into a tailwind for manufacturers after the sharp cost increases experienced after 2021. Elsewhere, inflationary pressure is persisting, mainly related to labour costs, energy costs, further supplier compensation costs and some persistent logistics and supply chain constraints in some regions. Labour costs are expected to rise more markedly for those original equipment manufacturers exposed to the new labour agreements concluded in North America between employers and the United Auto Workers and Unifor trade unions in Q4 2023, principally for Stellantis NV, the owner of the Chrysler, Ram, Dodge and Jeep brands.

To offset inflation, the industry will accelerate efforts to lower fixed costs by reducing headcount and enhancing existing cost-competitiveness measures. They range from increasing the proportion of platforms and parts shared across different products and brands, optimising the companies’ manufacturing footprint, digitalising processes and moving to direct customer sales to save on distribution costs. We anticipate a strong focus on battery-EV cost reduction to address the slower-than-expected improvement in EV contribution margins (revenue minus variable costs) due to two factors: the price war initiated by Tesla early in 2023 and the growing competition from low-cost Chinese EV manufacturers, led by BYD Co.

While our analysis focuses on the industrial businesses of automotive manufacturers, we monitor closely the risks associated with their captive-finance operations. After two extraordinarily strong years (2021-2022), we expect further normalisation of profitability (as measured by return on equity), reflecting higher cost of credit risk from historical lows in 2021, lower interest margins due to higher refinancing costs, passed on to customers with a time lag, and less supportive used-car prices, which had triggered high residual values and high remarketing gains.

Figure 2: Average EBITDA margin and revenue growth for automotive companies under coverage

Source: Scope Ratings

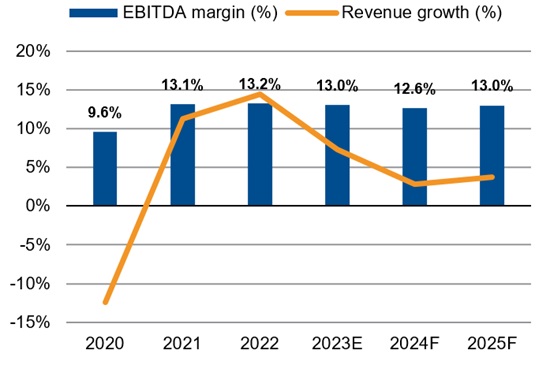

Further increases in capex and R&D will remain manageable

The industry will preserve its capacity for cash generation despite continued pressure on investment spending (capex and R&D) related to the industrial and technological transformation the sector is going through. These needs are primarily driven by environmental regulation focused on replacing ICE- powered vehicles with EVs, which has required the automotive manufacturers to invest massively in new vehicle architectures, EV line-ups, battery cell and component manufacturing, while repurposing existing ICE production lines.

While the industry has earmarked significant funds for future technologies (electrification and software), which are expected to peak in 2025-2026, the recent slowdown in the pace of EV adoption has led some automakers to scale down their EV investments and reassess the pace of their EV model rollout. In any case, more selective and greater prioritisation in investment decisions is likely, with no major M&A activity except for EV-related, bolt-on acquisitions and partnerships, and the continuation of prudent financial policies.

The companies will retain some flexibility in total shareholder remuneration after the generous share buybacks in the past two years.

Figure 3: Capex and cash R&D ratio for covered automotive manufacturers

% of industrial revenues

Source: Scope Ratings

All in all, the automotive manufacturing industry is in a healthy situation today, despite the mild short-term pressure on profitability. The industry has the capacity to fund investment due to significant liquidity buffers, and low leverage given the limited external debt in the company’s industrial operations, reflected in sizeable Scope-adjusted net cash positions.

We expect automotive manufacturers to maintain robust credit metrics. As such, financial risk profiles of the industry’s players remain the main support for issuer ratings.

To download the full Corporates Outlook 2024, please follow this link.

Webinar: Tuesday, 20 February at 15:30 CET

Please join Scope Ratings analysts for an in-depth discussion of the European corporate credit outlook for 2024 by registering here.

Make sure you stay up to date with all Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds.