Announcements

Drinks

Türkiye: opposition victory makes continuation of policy normalisation more likely

By Thomas Gillet and Tom Giudice, Sovereign and Public Sector

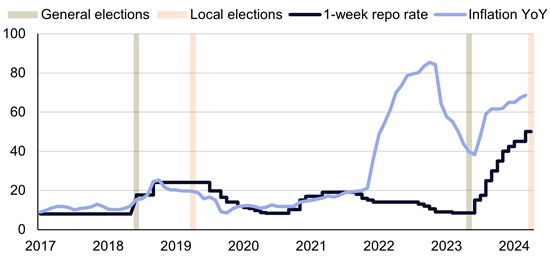

The success of opposition parties in Türkiye’s (B-/Stable) local elections, in which they kept control of Istanbul and Ankara, is partly attributed to voters’ frustration with the economy, not least persistently high inflation, running at 68.5% year-on-year in March. Inflation reduced real income and purchasing power, including for pensioners who support the AKP.

The result supports our view that the Central Bank of the Republic of Türkiye (CBRT) will continue targeting inflation in line with its monetary-policy pivot last year, a credit positive. The bank’s objective is to bring year-end inflation down to 9% in 2026 driven by significant interest-rate hikes.

This sustained shift toward a more consistent and independent monetary policy supported our revision of Türkiye’s outlook to Stable from Negative on 12 January.

The pre-election action by the CBRT further confirmed our view. In addition to regulatory measures, the CBRT raised its rate to 50% for 1-week repos from 8.5% since May 2023, including a 500 basis-point hike on 22 March. These decisive steps further improve the central bank’s credibility, which was significantly impaired by the unorthodox policies pursued in 2021-22. (Figure 1).

Figure 1. Türkiye sticks to inflation- vs election-driven monetary policy

%

Source: Macrobond, CBRT, Scope Ratings

Smooth electoral process, monetary tightening support investment in lira denominated assets

The fact that President Recep Tayyip Erdoğan accepted the electoral outcome supports the country’s institutional strength, as it demonstrates the official recognition of opposition parties by Türkiye’s political leadership and institutions. It also makes constitutional amendments to overturn a two-term limit on the presidency less likely. This demonstration of a functioning democratic process could reassure investors and lead to higher investment in lira denominated assets, which are now more attractive for foreign investors given higher policy rates.

Under the baseline of continued restrictive monetary policy, we project inflation to rise to 60% on average this year, compared with 53% in 2023. This balances heavy pressure on prices in the first half and a downward trajectory in the second half of this year due to the lags of monetary policy and favourable base effects. In 2025, inflation is expected to recede to 25% on average, which is still significantly higher than the CBRT target of 5%.

Exchange-rate volatility, wage growth may cloud the inflation outlook

However, continued downward pressure on the lira could delay the disinflation process, as could sudden changes to the leadership of the CBRT and a premature end of the tightening cycle.

Although the CBRT operated a controlled devaluation of the lira ahead of local elections, with the currency depreciation by 8% against the dollar (6% against the euro) year-to-date, a further devaluation is likely in the coming months given shrinking net foreign assets of USD 6.9bn at end-March, down from USD 27.2bn at end-December.

This would be a repeat of what happened in June 2023 when the currency fell 20% against the dollar (23% against the euro), and 36% in 2023 (39%), increasing the price of energy which accounts for around 20% of imports.

Still, a weak currency is not the only source of inflationary pressure. The disinflation process could be delayed by a further rise in the minimum wage after that of almost 50% in January. Fiscal policy is also tighter but generally still accommodative following the February 2023 earthquake. The headline fiscal deficit is running TRY 425bn year-to-date, a 86% rise from the same period in 2023.

Restrictive policy stance will hurt domestic economic activity

Rebalancing the economy remains a significant challenge as tighter fiscal and monetary policy worsen the economic growth outlook. Real GDP growth is projected at 3.3% in 2024, after 4.5% in 2023, and 3.5% in 2025. Such performance would still be robust albeit much weaker than the 5.2% recorded on average over the past 10 years.

Scope’s next calendar review date for Türkiye is 28 June.