Announcements

Drinks

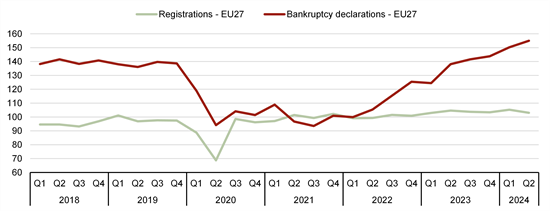

European corporate defaults still months from stabilising after sharp rise in second quarter

Scope Ratings says geopolitical tensions, sluggish economic growth, the absence of larger state-driven support programmes and fading positive effects from post-pandemic pent-up demand in some sectors are partly responsible. So too is the caution of central banks in reducing interest rates given still high levels of inflation which continues to exert pressure on companies, visible in rise in corporate defaults across Europe in the first half of 2024. Latest Eurostat default statistics show a new interim record of company defaults in Q2 2024, more than offsetting the number of new businesses created.

Corporate stress: bankruptcies settle at a high level

FY 2021 = 100 (seasonally adjusted)

Source: Eurostat, Scope

Ratings pressure on persists amid signs of stabilisation

“Our assessment of approximately 300 companies indicates sustained ratings pressure and elevated default risk, with negative rating actions (see note below) affecting about 25% of the credit portfolio in H1 2024, mirroring trends from FY 2023,” says Sebastian Zank, head of Corporates Credit Production at Scope. “Additionally, we have recorded three selective defaults during this period,” Zank says.

Notably, non-investment grade companies are disproportionately impacted, with around 40% experiencing negative rating actions and 20% maintaining a Negative Outlook. In contrast, investment grade credits have seen a more favourable trend, with positive rating actions outpacing negative ones, and only 10% of IG ratings carrying a Negative Outlook. This divergence highlights a widening gap between solidly rated corporates, which are generally strengthening their credit profiles, and speculative credits, which are becoming increasingly vulnerable.

However, the growing optimism about future interest-rate cuts as inflation subsides will combine with a slow economy recovery towards the end of the year. Output in the euro area will return to more solid growth of 1.0% in 2024 and up to 1.7% in 2025 after stagnation in 2023.

“Many corporations are successfully adapting to the challenging environment, with cost-saving programmes beginning to bear fruit,” says Zank. “The European Central Bank’s latest bank lending survey also indicates easing pressure on the tightening of lending standards, providing some relief to businesses,” Zank says.

These supporting factors suggest that while the risk of corporate defaults remains, the situation could stabilise, with the most severe pressures beginning to abate towards the end of 2024.

Related research

- European retail: defaults still on rise after jump in 2023; discretionary-goods suppliers at risk, Jul 2024

- Germany’s auto parts sector: defaults point to consolidation in cyclical downturn rather than crisis, Apr 2024

- Europe faces further rise in corporate defaults: insolvencies to plateau only late 2024, early 2025, Oct 2023

- EU firms face growing interest-cost headache - Higher rates combine with bulge in maturing 2024-26 capital-market debt, Oct 2023

Note: Negative rating actions = Downgrades, Negative Outlook revisions, Under Review placements for a possible downgrade; Positive rating action = Upgrades, Positive Outlook revisions, Under Review placements for a possible upgrade