Announcements

Drinks

France: political uncertainty weighs on public finances and funding conditions

By Thomas Gillet and Brian Marly, Sovereign and Public Sector

President Emmanuel Macron’s choice of Michel Barnier, a centre-right politician and the EU’s former Brexit negotiator, as France’s (AA/Negative) new prime minister leaves open the question of whether he can form a stable government with enough support in a deeply divided parliament to materially reduce the budget deficit and enact major supply-side reforms necessary to bolster the economy’s growth potential.

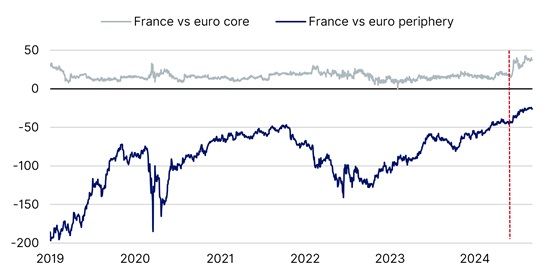

The yield spread between French 10-year government debt and those of core euro area countries has widened to around 40bps, up from a 5-year average of about 15bps, since President Macron’s decision to call early legislative elections (Figure 1). This points to a moderate, albeit rising divergence of France’s funding conditions compared to those of AAA-rated countries.

France’s G7 status, economic resilience, weight in European governance, and robust institutional strength have so far mitigated concerns over successive budget deficits of French governments. However, the additional degree of political uncertainty since the snap elections in June, has combined with a deteriorating fiscal outlook despite the post-pandemic economic recovery.

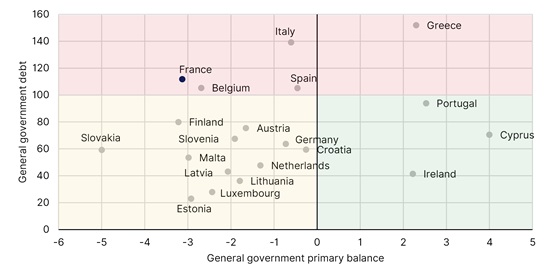

France’s 2024 deficit is likely to be revised up to 5.6% of GDP from 5.1% planned in the stability programme. This points to another year of fiscal slippage as the 2023 deficit had already been revised to 5.5% of GDP from the planned 4.9%. France is thus set to record the second widest budget deficit among euro area countries, after Slovakia (5.9% of GDP), and significantly above the 3% Maastricht threshold.

Figure 1. France’s funding costs rising vs core euro countries, convergence with periphery

Spread, 10-year government bond yield, basis points

Note: dotted line refers to President Macron calling early legislative elections. Average spread vs core (Austria, Finland, Germany, Netherlands) and euro periphery (Greece, Italy, Portugal, Spain). Source: Macrobond, Scope Ratings

Political uncertainty drives further convergence with euro area periphery

France’s bond spread with euro area peripheral countries began tightening before the early legislative elections this summer. This convergence reflects both, France’s challenging credit outlook, but also the strengthening credit fundamentals of countries such as Greece (BBB-/Positive), Portugal (A-/Positive) and Spain (A-/Positive), which have significantly reduced their government debt, including via achieving primary balances or surpluses (Figure 2). As a result, France’s spread to the periphery has narrowed to -25bps, well below a 5-year average of about -95bps.

Figure 2. France runs one of the largest primary deficits

% of GDP, 2024F

Note: IMF, Scope Ratings. Source: Macrobond, Scope Ratings

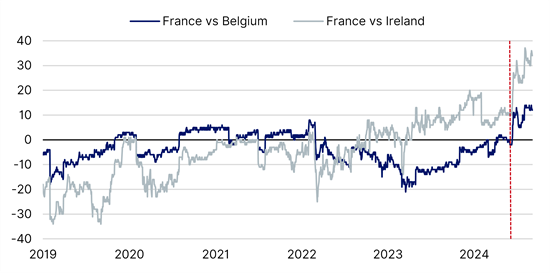

France’s relative funding conditions shifting compared to other AA-rated credits

The spread against Belgium (AA-/Negative) has shifted from negative to positive in early June, to around 10bps, up from -4bps on a 5-year average, despite Belgium’s fiscal and political challenges. Similarly, France’s spread against Ireland (recently upgraded to AA/Stable) has increased since President Macron called the snap elections, up to 30bps from around -6bps on a 5-year average (Figure 3). Ireland benefits from a primary surplus, moderate and declining level of government debt, and the prospects for significant liquidity buffers in the medium term.

Figure 3. Reversal of France’s spread against Belgium and Ireland

Spread, 10-year government bond yield, basis points

Note: dotted line refers to President Macron calling early legislative elections. Source: Macrobond, Scope Ratings

Resilient economy exposed to political paralysis

Despite the political uncertainty, France’s economy remains resilient with real GDP growth better than expected in Q2 2024, underpinning our revised forecast of 1.0% growth this year, up from of 0.8%, in line with 1.1% in 2023. Buoyant private consumption amid lower inflation and improving real incomes is supporting growth.

Moreover, France benefits from highly liquid debt markets, a favourable debt profile, and the safe-haven status with investors’ “flight to quality” in times of crisis. Still, despite these credit strengths, progress on supply side reforms and spending cuts are needed to ensure government debt returns to a firmer downward trajectory from 110.6% of GDP in 2023.

Scope’s next calendar review date is on 18 October 2024.