Announcements

Drinks

France: multi-year budget plan supports fiscal outlook but great uncertainty remains

By Thomas Gillet and Brian Marly, Sovereign and Public Sector

France’s (AA-/Stable) government affirmed its commitment to stabilise the public debt trajectory by 2029 through savings and supply-side reforms, following two years of budgetary slippage that resulted in a budget deficit of 5.8% in 2024, the highest in the euro area.

Under prime minister Bayrou’s EUR 44bn of measures for the 2026 budget, equivalent to around 1.5% of GDP, the government plans to keep public spending unchanged relative to 2025 – excluding military expenditure and interest payments. According to the plan, this will be achieved primarily through a nominal freeze on social benefits (including pensions) and income tax bands, alongside local government savings.

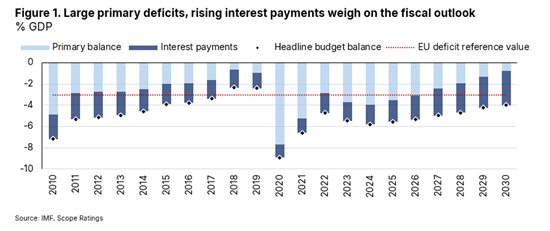

If fully implemented, which is unlikely in our view, the government’s plan would reduce the deficit from an expected 5.4% in 2025 to 4.6% in 2026 and 2.8% in 2029. Instead, we expect a much more constrained and gradual fiscal consolidation path with the budget deficit still at 5% of GDP in 2027 and 4% in 2030 (Figure 1).

This is because the impact of the savings plan on the headline deficit will be partially offset by the steady increase in net interest payments, from less than 4% of government revenue in 2024 to more than 6% by 2030. So, while the primary deficit is expected to return to its pre Covid level of less than 1% of GDP by 2030, the headline deficit will remain elevated around 4%.

Savings challenged by economic slowdown, parliamentary fragmentation and rising defence expenditure

The prime minister’s measures to support domestic production include the elimination of two bank holidays, the reduction of red tape for businesses and greater labour market flexibility through upcoming negotiations with social partners on the unemployment benefit system.

However, the introduction of ambitious structural reforms to support GDP growth, estimated at around 1% annually, appears unlikely in the near term. Modest economic momentum will weigh on the social acceptability of economic and budgetary reforms. We are projecting real GDP growth of 0.8% on average in 2025-26, after 1.1% in 2024, amid external headwinds including the United States’s (AA/Negative) trade policy.

In addition, the lack of a parliamentary majority since the 2022 legislative elections, the fragmented political landscape and heightened political polarisation following the 2024 dissolution of the National Assembly raise further uncertainty about the government’s ability to implement its saving plan for 2026.

Parliamentary discussions are expected to be challenged by difficult budgetary trade-offs to compensate for higher defence expenditure, projected to reach EUR 64bn in 2027 or about 2% of GDP. Discussions around the 2023 pension reform following this year’s negotiations with social partners could also complicate the parliamentary debate.

The need to strike a political compromise on the proposed economic and budgetary reforms will likely lead the government to water down some of its measures to appease political opposition, at the risk of missing next year’s deficit target.

Conversely, relying on article 49.3 of the Constitution to pass the 2026 budget without a parliamentary vote will raise the risk of renewed political instability, following the collapse of the former government in December 2024. A successful no-confidence vote against the prime minister and/or early elections would undermine near-term fiscal consolidation.

Political hurdles compound uncertainty around the government’s saving plan

Upcoming elections – municipal elections in March 2026 and presidential elections in April-May 2027 – raise further uncertainties about budgetary efforts over the medium term.

Reducing the deficit to below 3% of GDP by 2029 would require a savings plan of more than EUR 100bn, according to the French Court of Auditors. This is unlikely, given the uncertainty surrounding the policy agenda after the 2027 elections.

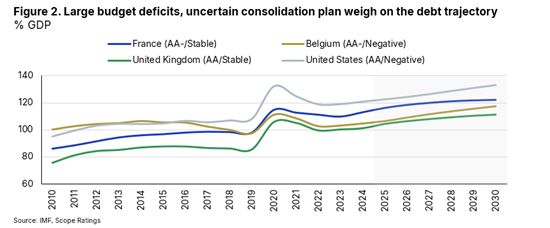

Balancing the government’s savings plan and the uncertainties around its implementation over the coming years, we believe general government debt-to-GDP will increase from about 113% in 2024 to 122% in 2030 (Figure 2). This would be one of the largest debt increases among highly-indebted developed countries, including Belgium (AA-/Negative), the United Kingdom (AA/Stable), and the United States (AA/Negative).

Scope’s next calendar review date is on 26 September 2025.