Announcements

Drinks

Ireland's export-led economy looks robust enough to withstand higher US trade tariffs for now

By Thomas Gillet and Elena Klare, Sovereign and Public Sector

If the proposed 15% tariff regime proves durable, companies in sectors crucial to the Irish economy – aeronautics and pharmaceuticals – are unlikely to move production facilities out of Ireland given the country’s favourable business environment.

Relocating production would encounter several strategic, operational and regulatory hurdles for companies, underpinning our view that the country's EUR 1trn stock of foreign direct investments is likely to remain in these high value-added sectors.

Still, some uncertainty surrounds the pharmaceutical sector given there is a US (AA/Negative) investigation into a possibly higher sector-specific tariff that could potentially disrupt supply chains and investment in research and development.

While the preliminary US-EU deal lacks detail and requires approval by EU member states, it does lower the risk of a trade war involving EU retaliation with reciprocal tariffs on US exports, including digital services, which are an important sector for Ireland.

However, the shift in US trade policy has shown the vulnerability of the Irish economy’s exposure to US markets and multinational enterprises (MNEs), emphasising the urgency of domestic structural reform and investment to compensate for more volatile trade relations and protect public finances.

Strong public finances, robust economic growth underpin the rating

Ireland's wealthy economy and robust fiscal position, supported by exceptionally strong corporate income tax receipts, anchor our AA rating with Stable Outlook, which we affirmed on 25 July.

Corporate tax revenue reached EUR 39.1bn (36% of Exchequer revenue) in 2024, up from EUR 29.3bn in 2023, bolstered by a one-off EUR 14bn payment by Apple to the government following a court ruling. Corporate tax is expected to remain substantial at EUR 29.3bn in 2025 (28% of revenue) and EUR 28.1 bn in 2026 (27%), the tariffs notwithstanding.

We thus expect the general government budget balance to remain in surplus, running this year at around 2.6% of GNI* (a measure of the size of the Irish economy excluding distortions related to the activities of MNEs) and around 2.3% on average between 2026-30. Notably, without excess corporate tax revenues the general government budget balance would be in deficit of around 1% to 2% of GNI*.

While the dependence on MNEs remains a key vulnerability – just 10 companies pay 57% of all corporation tax receipts and just three account for 40% of them – robust corporate-tax income and economic growth underpin the favourable trajectory of government debt.

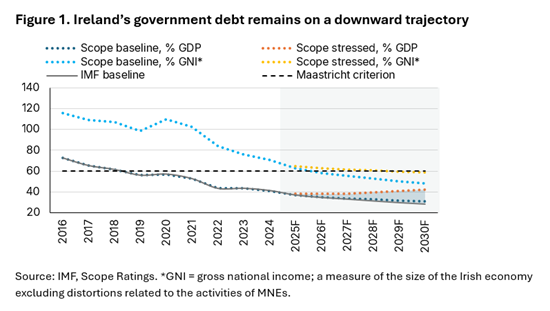

Debt-to-GNI* is likely to decline to 63% in 2025 and less than 50% by 2030 from 68% in 2024, with debt-to-GDP falling to 30% from around 40% over the period (Figure 1).

Growing strategic reserves to help Ireland meet welfare and infrastructure challenges

The government's strategic approach to windfall revenues strengthens the fiscal outlook through the two sovereign funds established in 2024.

Although transfers only account for a relatively modest portion of windfall corporate tax receipts, sovereign funds provide a buffer to address pressing structural challenges facing the economy.

Assuming the government transfers around 0.8% of GDP a year to the Future Ireland Fund until 2040, the fund could grow to around EUR 100bn, allowing future governments to draw down investment returns from 2041onwards to tackle the health and welfare costs associated with Ireland’s ageing population.

The government is also accumulating resources for the modernisation of infrastructure and to address climate change with EUR 2bn annual flows to the Infrastructure, Climate and Nature Fund from 2025-2030.

Our assessment of Ireland's favourable refinancing profile further supports the fiscal outlook, with less than 40% of outstanding debt maturing within five years and a weighted average debt maturity exceeding 10 years. The National Treasury Management Agency's cash balance of EUR 30bn (around 5% of GDP) provides further substantial financing flexibility.

Supply-side constraints, public investment needs are challenges

Eliminating supply-side bottlenecks remains a significant policy challenge, with the economy operating at capacity while facing labour and skills shortages.

The government’s updated National Development Plan includes EUR 102.4bn in capital investment between 2026 and 2030, with overall investments of EUR 275.4bn by 2035, but execution risks remain elevated given the tight labour market and lengthy processes.

Addressing these supply-side constraints through labour-market reform will be crucial for the economy to absorb the ambitious infrastructure spending on housing, water, energy, and transport.

The implementation of the National Development Plan could over time enhance Ireland’s growth model and support competitiveness, while mitigating its exposure to global shocks as a small, open and financially interconnected economy.