Announcements

Drinks

Five reasons why Trump’s trade war is likely to escalate

By Dennis Shen, Scope Macroeconomic Council

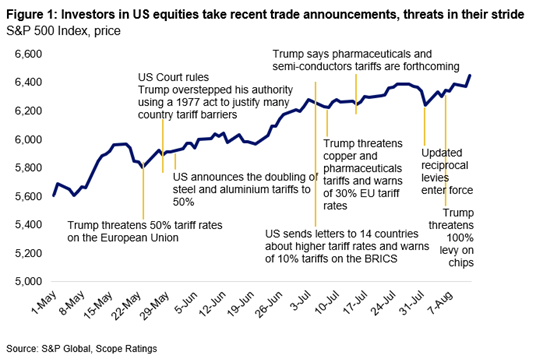

#1 – Markets encourage risk taking. With US equities at or near record highs, there is space for President Donald Trump to risk some unpopularity. One of the primary checks on his presidency is the stress his policies place on the capital markets. Market sell-offs are inevitably met with exercise of the “Trump put”. Markets are growing complacent to US trade escalations and de-escalations and are increasingly sanguine around the economic consequences (Figure 1).

Loosening the market straitjacket raises the risk of escalations in trade conflicts. Financial market volatility is near multi-year lows, suggesting markets no longer view the 15%-20% blanket duties floated recently by Trump as a penalty but as the new normal.

#2 – US economy resilient. Second quarter GDP rebounded 0.7% quarter-on-quarter and the normally dependable GDPNow model suggests positive US growth in Q3. While we have reduced our 2025 growth forecast on the US to 1.8%, this is higher than growth across most advanced economies. We have raised 2026 US growth to 2.1%. Although current tariffs are much higher than in recent decades, they are not high enough to impose effective embargoes on imports or cause severe economic losses. In addition, price rises from higher trade barriers have taken longer than anticipated to meaningfully lift inflation.

#3 – Rising customs revenues are helping to trim the US budget deficit. US Treasury data point to customs duties increasing to a record USD 66bn in Q2, with a further USD 28bn collected in July. This compares with monthly averages of less than USD 7bn last year. This revenue helps trim the burgeoning US general government deficit, which we estimate at an elevated 5.4% of GDP this year.

#4 – Trading partners’ responses have been limited and bilateral. Despite the many threats of reprisals, only China and Canada have significantly countered US tariffs. Many other governments including the UK and those in the EU have been wary of harming multilateral trading rules and global supply chains as well as weaker growth and higher prices from any escalation. Trading partners have responded by pledging more than USD 1trn of investment in the US to appease Trump and de-escalate, while slashing duties on US imports and facilitating market access for US goods.

Reliance on US security guarantees – and Washington’s willingness to withhold them – has compelled many countries, including in the EU, to give some ground. Trump’s preference for bilateral rather than multilateral negotiations has limited any reprisals and encouraged competition within regional clusters for preferential trading terms with the US. As long as the responses of trading partners remain bilateral rather than multilateral, a trade war favours the US.

The widening gap between tariffs imposed by the US and those imposed by trading partners on the US as well as on one another has created a two-tier global trading system that may strengthen relative trading terms for the US in the longer run, helping to curtail annual trade deficits.

#5 – Conducive domestic politics currently favour escalation. Republican Party concerns about major losses in 2026 mid-term elections have eased as the president’s approval rating remains around 90% with his party’s voters. The passage of the “Big Beautiful Bill” has bolstered the president’s political capital.

Average duties at multi-decade highs cut global output

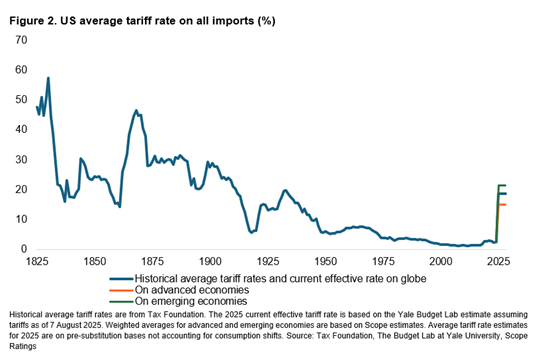

Average US customs duties have risen sharply to 18.6%, up from 2.5% at the end of 2024 and 1.5% in 2016 ahead of Trump’s first administration. While current tariffs remain off the “Liberation Day” highs of nearly 30%, they are still at their annual highs since the 1930s (Figure 2). This includes 15% average duties on advanced-economy trading partners and 21.4% on emerging economies.

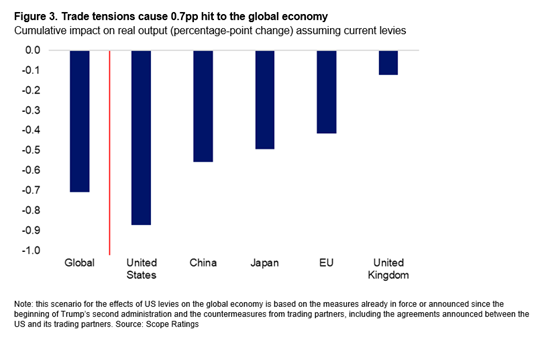

This has consequences for the global economy: we project a cumulative medium-term reduction in global output of 0.7pps (Figure 3). The effects on the US economy are only slightly greater, at 0.9pps, as re-shoring gradually trims the cumulative costs. We estimate more modest consequences for the EU economy, at 0.4pps. We have reduced our 2025 global growth forecast by 0.4pps to 3.0%.

See also:

EU’s sluggish economy faces moderate growth slowdown from US trade tensions, July 2025

Scope’s 2025 mid-year global economic outlook (report), June 2025

Scope's 2025 mid-year economic and credit outlook (presentation), June 2025

US trade policy: wide-ranging tariff increases heighten global credit risk, April 2025

*Arne Platteau, analyst in Credit Policy at Scope Ratings, contributed to this research.

The Scope Macroeconomic Council brings together credit opinions from ratings teams across multiple issuer classes: sovereign and public sector, financial institutions, corporates, structured finance and project finance.