Announcements

Drinks

Federal Reserve runs risk of loosening before inflation is contained

By Dennis Shen, Scope Macroeconomic Council

A rate cut will partly satisfy dovish capital markets, however, which have priced in a cut as a near certainty, with some even anticipating a 50bp move. A cut might also partially appease political pressure from a US administration pushing for significant easing.

But by front loading rate easing, the Fed runs the risk of loosening before the inflation genie has been put firmly back in the bottle. This raises the danger of repeating its mis-steps last September, when the Fed trimmed rates by 50bp under market pressure, citing labour market weaknesses that proved short lived. The fall in immigration means fewer jobs need to be created to keep labour markets in balance, weakening the case for aggressive easing.

Federal Reserve Chairman Jerome Powell may nonetheless justify a rate reduction by pointing to weak August payrolls, sharp downside revisions of previous payrolls, the tick higher in unemployment and higher initial jobless claims. The recent decline in the producer price index, downward revisions to July figures, alongside the moderation in select core price rises (suggesting the effects from tariffs remain muted) could also be used to back the case for easing.

Jumbo 50bp cut unwarranted

The jumbo 50bp cut that some market participants believe is in play is neither warranted nor likely given that many Federal Open Market Committee (FOMC) voters may be on the fence for even a 25bp cut. Current risk appetite in capital markets argues against a larger move. A 50bp cut could be interpreted as tacit admission that Powell, who has repeatedly warned against easing too quickly, has waited too long, unintentionally reinforcing the “Mr. Too Late” label from the US president.

The bigger question may be less around whether the Fed eases on Wednesday and more around what happens after September. A cut on Wednesday may well be followed by further rate reductions. But whether the next cut occurs by the December FOMC meeting hinges on the economic data, the inflation outlook as well as market and political pressures.

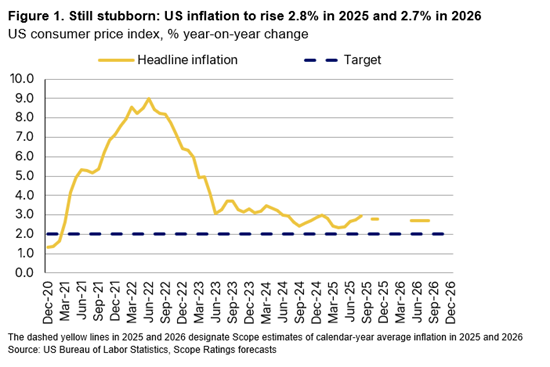

Powell will probably signal open-mindedness around further rate reductions but will also underline his caution given above-target inflation (Figure 1), such as services inflation of 3.8%. Financial markets are likely to see this as hawkish: investors have been pricing in three 25bp cuts by the end of the year, raising the risk of tighter financial conditions if these expectations are not met. Even the decision on Wednesday may see dissent in either direction.

We believe inflation will ease slightly by next year, but higher tariffs and their second-round effects, a resilient economy and an expansionary budgetary policy mean inflation risks remain. Core inflation in August at multi-month highs of 3.1% year-on-year is concerning.

Market participants under-estimate challenges to Fed independence

Market participants appear to be under-estimating the implications of rising political pressure on the Fed. President Trump is calling for 300bp of prompt rate cuts, Trump loyalist Stephen Miran has been appointed to the Fed’s board of governors, while the president is seeking to dismiss Governor Lisa Cook.

The increasing politicisation of the central bank raises the risk that monetary policy will lean increasingly in a dovish direction. Such pressures could undermine price and financial stability in the long run, with ripple effects for macroeconomic stability and the dollar, including accelerating de-dollarisation.

The Scope Macroeconomic Council brings together credit opinions from ratings teams across multiple issuer classes: sovereign and public sector, financial institutions, corporates, structured finance and project finance.