Announcements

Drinks

EBRD faces limited credit risk from reduced exposure to Russia, Ukraine as crisis worsens

By Alvise Lennkh, Deputy Head of Sovereign and Public Sector Ratings

By Alvise Lennkh, Deputy Head of Sovereign and Public Sector Ratings

The escalating armed conflict between Russia (BB+/Under Review for downgrade) and the Ukraine (CCC/ Under Review developing outcome) will have important consequences on corporate and public-sector borrowers in both countries, leading to a rapidly deteriorating outlook for asset quality and equity valuations.

The European Bank for Reconstruction and Development – see Scope’s Rating Report, December 2021 – is active in both countries as a multilateral development bank (MDB) – as well as in neighbouring Belarus– though its exposure has declined markedly since 2010.

The bank faces a potential deterioration of its portfolio quality, along with other creditors in these countries. Still, the EBRD’s credit strengths, including ‘very strong’ financial and institutional profiles, and ‘very high’ shareholder support, provide comfortable buffers to the bank’s AAA rating.

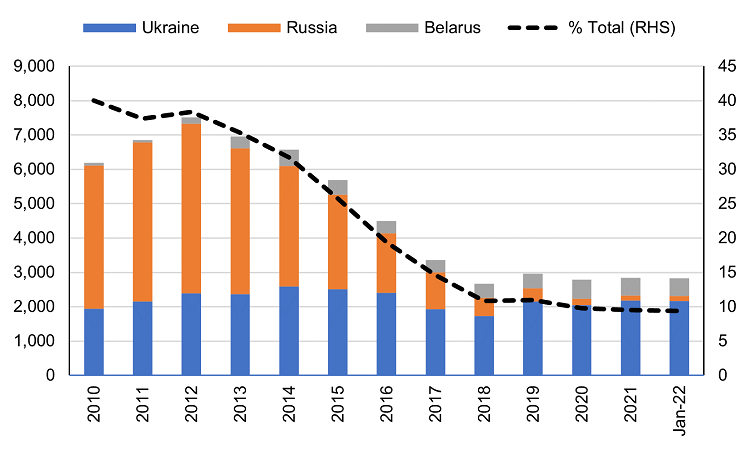

The overall loan exposure to Ukraine, Russia and Belarus has declined by more than half to around EUR 2.8bn as of January 2022 from about EUR 6.2bn in 2010. Loans to the countries make up around 9.4% of the bank’s total lending, down from 40% in 2010. The bank has not signed new projects in Russia since 2014 and more recently stopped new signatures in Belarus.

This week, the bank’s board of directors voted to suspend EBRD finance and expertise to Russia and Belarus open-endedly at a meeting 1 March. The decision needs to be approved by its board of governors within 30 days by a two-thirds majority representing at least three fourths of total voting power of members.

The EBRD’s exposure to Ukraine, Russia and Belarus

EUR m; % of total exposure

Source: EBRD, Scope Ratings GmbH

Source: EBRD, Scope Ratings GmbH

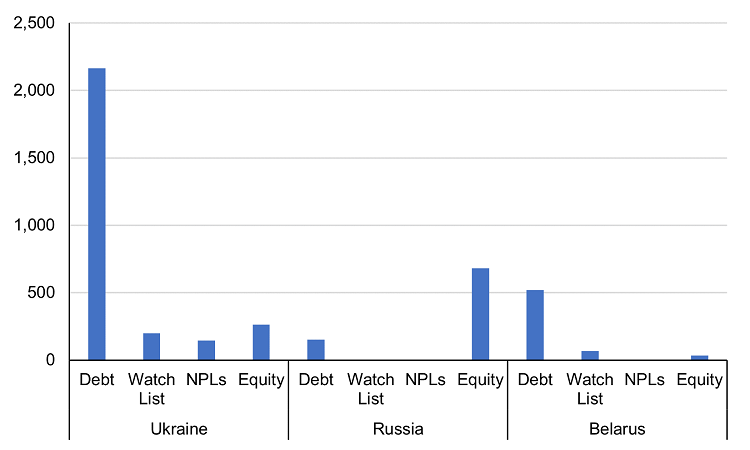

Breadown of EBRD exposure to Ukraine, Russia and Belarus

EUR m

Source: EBRD, Scope Ratings GmbH

Source: EBRD, Scope Ratings GmbH

The EBRD is a key institutional player in fostering economic development in the Ukraine, with outstanding amounts of about EUR 2.4bn, or 7% of the bank’s total outstanding development related assets, of which EUR 2.2bn relate to loans, mostly to industry, commerce and agribusiness (EUR 1.0bn) followed by exposure to the sovereign (EUR 0.7bn) and sustainable infrastructure (EUR 0.5bn). Equity exposure in the country stands at a low at EUR 263m, about 1.3% of the bank’s equity and reserves.

Looking at loan exposure in Russia, we note that these have markedly declined from around EUR 4.2bn in 2010 to around EUR 150m, or from about 27% of total exposure to less than 0.5% as of January 2022. However, equity exposure remains relatively high at around EUR 700m, or about 3.5% of the bank’s equity and reserves of EUR 19.8bn as of Q3 2021. Still, of these investments, about one third relate to diversified funds, lowering risks. Nonetheless, should the conflict and/or elevated sanctions persist throughout the year, we expect valuation and currency depreciation effects on the equity portfolio in Russia to be significant as these constitute about 15% (on a costs basis) of the bank’s total share investments (EUR 4.4bn) as of January 2022, and thus weigh on the bank’s 2022 net results.

Provision levels for non-performing exposures in the affected countries are elevated: non-performing loans amounted to EUR 147m in Ukraine (provisioned at 42%), EUR 1.3m in Russia (provisioned at 54%) and EUR 3.5m in Belarus (provisioned at 29%). Acknowledging the prevailing uncertainty, we expect an increase in non-performing exposures, and associated provisions, in 2022, reducing net profits further.

For example, in 2014 the bank’s non-performing loans increased to EUR 1.2bn, from EUR 660m in 2013, leading to an increase in the NPL ratio from 3.3% to 5.6%. The bank’s NPL levels were already relatively high before the conflict escalated, at EUR 1.6bn or 5.4% of total loans at H1-2021. However, we note positively that the EBRD’s profitability, with an expected net profit of more than EUR 2bn for 2021 (EUR 1.5bn as of H1-2021), provides the bank with significant buffers to absorb any losses stemming from the Russia-Ukraine shock this year. As of Q3 2021, accumulated reserves stood at EUR 13.5bn.

Critically, should the bank’s asset quality deteriorate meaningfully in Ukraine, Russia and Belarus, we would expect the bank to continue to benefit from its track record of being exempt from debt restructurings from sovereign and public sector exposures, which comprise about 30% of the portfolio in the Ukraine. Similarly, we would expect its private exposures to be exempt from transfer and convertibility risks. This was seen during the 1998 Russian crisis, the restructuring of Ukreximbank, and defaults by sovereign-guaranteed municipal borrowers in Tajikistan. This is an important assumption underpinning our AAA assessment.

Julian Zimmermann, Analyst, contributed to this commentary.