Announcements

Drinks

EU financial support represents modest boost for Africa’s growth outlook

.jpg) By Thomas Gillet, Associate Director, Sovereign and Public Sector

By Thomas Gillet, Associate Director, Sovereign and Public Sector

The EU (AAA/stable) and African Union announced investment of at least EUR 150bn at their summit last month, equivalent to half of the EUR 300bn Global Gateway Investment Package launched in December 2021 by the EU as an alternative to China’s Belt and Road Initiative. The EU-AU investment plan follows the EU-Africa partnership announced in June 2020.

The EUR 150bn package represents around 9% of sub-Saharan Africa’s GDP and around 7% of the whole continent’s GDP. Details of the investment plan remain limited, but it should include contributions from Team Europe, EU budget, member states, and private investors. According to European sources, the EU would make payments of EUR 20bn a year, of which only 6bn would come from EU funds and the rest from EU states and private investors. For instance, the European Investment Bank has pledged EUR 500m in partnership with the WHO to mobilise EUR 1bn to strengthen public health in Africa.

Financial support provided by the EU through loans, grants and guarantees has long contributed to official development assistance globally. The latest EU financial package aims to support African countries by lowering pressures on budgets and spurring public investment in critical sectors such as the environment, digitalisation, employment, health and education.

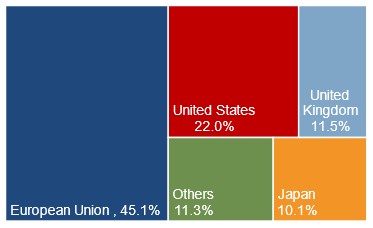

EU official development assistance makes up lion’s share of global total

Share of total 2020 ODA from OECD Development Assistance Committee members

Note: grant equivalent measure; ODA in 2020, preliminary data

Source: OECD, Scope Ratings

The programme is timely. The Covid crisis has required upfront public spending at the expense of critical longer-term investment. African countries’ gross financing needs have risen, while the pandemic has reversed recent progress in reducing poverty and inequality in line with the UN’s Sustainable Development Goals for 2030.

Even so, the EU financial package is relatively small compared with Africa’s investment needs. According to the African Development Bank, Africa needs more than USD 1trn a year:

- around USD 480bn over the next three years to address the socio-economic impacts of the pandemic and the support economic recovery;

- around USD 400-800bn per year to eliminate extreme poverty by 2030;

- USD 7-15bn a year to deal with climate change;

- up to USD 100bn per year to fix the infrastructure financing gap.

The latest EU financial package is unlikely to materially impact the growth and fiscal outlooks of African beneficiary countries given the immediate challenges they face. With the pandemic far from burnt out on the continent, rising interest rates constitute an important risk given the rise in public debt over the past decade. Many African governments have stretched balance sheets and little fiscal room for manoeuvre with frameworks for debt restructuring hamstrung by structural problems.

Political and institutional instability could also weaken the capacity of some countries to address those challenges in a timely manner which may undermine the swift disbursement of EU funds. Competition between international lenders, including with China, could be detrimental to Africa, if the rise in unconditional financial assistance leads national governments to postpone or limit critically needed structural reforms. Any material impact of EU financial support on Africa’s growth outlook is conditional on gradual implementation of reforms often in the context of the terms of financial assistance from international financial institutions.

Reforms are also important for scaling up private-sector investment which could help address Africa’s challenges. The recent rise in commodity prices is a boost for Africa’s many export-dependent countries but could again create complacency in pursuing the reforms needed for sustainable growth.

Europe and Africa have long had deep and close financial relations that could enhance Africa’s long term growth potential if they were to kick-start private investment and foster improved governance, transparency and quality infrastructures..

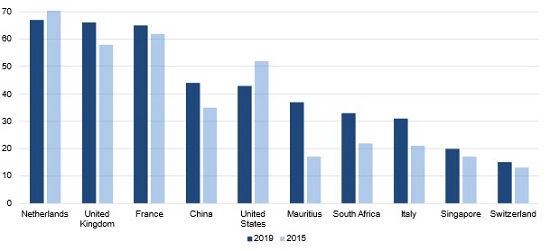

Top 10 investor economies to Africa by FDI stock

USD bn

Source: UNCTAD, Scope Ratings

Brian Marly, Associate Analyst, contributed to this commentary.