Announcements

Drinks

Russia: record current account surplus disguises longer-term impact of sanctions

By Levon Kameryan, Senior Analyst, Sovereign Ratings

By Levon Kameryan, Senior Analyst, Sovereign Ratings

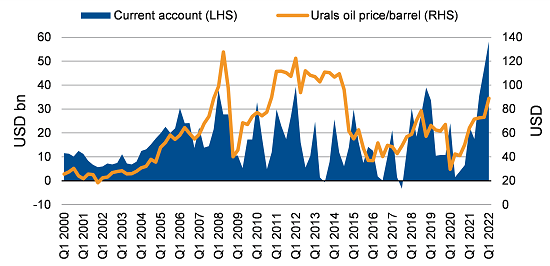

Russia’s current account surplus – a broad measure of the country’s trade, investment earnings and transfer payments with the rest of the world – widened to USD 58.2bn in Q1 2022, equivalent to nearly 10% of Central Bank of Russia (CBR)’s USD 609bn international reserves on April 8 (including sanctioned and frozen reserves), which are down from the record-high of USD 643bn before the invasion on 18 February.

The wider surplus reflects soaring revenues from Russia’s oil and gas exports – largely spared from international sanctions for now.

Without broader EU sanctions on Russian oil and gas, Russia’s current account surplus this year could be well above USD 200bn due to the collapse in imports and surging value of commodity exports, up from about USD 120bn in 2021. This would essentially enable the CBR to rebuild a large part of the international reserves that sanctions have frozen. Russia will speed up “de-dollarizing” reserves and foreign trade, including via increasing the exposure to Chinese yuan, while maintaining the reliance on euros. Russia currently conducts trade with China more in euros than in dollars, with EUR being the settlement currency for half of Russian exports to China, compared to about one-third for USD.

Russia recorded its highest ever current account surplus since at least 1994

Source: Bank of Russia, Ministry of Finance, OPEC, Scope Ratings

However, we are yet to see the full impact of sanctions and resulting consequences of the war in Ukraine on Russian foreign trade and the domestic economy, even if there is no near-term oil or gas embargo. First, sanctions are leading to a painful adjustment in imports by Russian private sector, disrupting more than half of Russia’s imported high-tech goods as well as a significant part of imported machinery and equipment, which are key for industrial production. The resulting loss of access to foreign technology will weaken Russia’s already moderate medium-run growth potential, which we had estimated at 1.5%-2% annually before the war, while we expect that Russian GDP will contract by at least 10% this year.

Secondly, an acceleration in European efforts to diversify energy imports away from Russia will exacerbate Russia’s medium-run economic challenges given the lack of an ambitious government policy to address the economy’s structural reliance on energy exports. The EU, overall Russia’s largest trading partner, recorded imports of Russian petroleum, natural gas, and related products worth EUR 100bn in 2021. The EU’s plan to shed its dependence on Russian gas by 2030 could be brough forward - driven by Germany’s ambition to substantially cut Russian gas dependence by 2024 - by diversifying gas supplies via higher Liquefied Natural Gas (LNG) and pipeline imports from non-Russian suppliers.

We expect to see an acceleration in Russian efforts to counteract European measures partly through greater energy cooperation with China. Full substitution, however, is out of reach any time soon.

Importantly, today Russia does not have the infrastructure capacity to redirect pipeline gas from west to east of Russia. The capacity of Russia’s eight pipelines suppling gas to Europe is around 220 bcm/year, almost six times that of the one pipeline to China, Power of Siberia, which is not operating at full capacity yet and is expected to reach 38 bcm/year by 2025. In February, Russia signed a 25-year agreement with China for the supply of an additional 10 bcm of natural gas per year. Additionally, Russia is currently planning to develop the Power of Siberia-2 pipeline to deliver an extra 50 bcm/year gas to China. The construction of the pipeline, however, is expected to conclude only by 2030.

In this context, Russia’s demand to so-called “unfriendly countries”, including EU member states, to exchange dollars and euros for roubles to pay for Russian gas through a Russian bank reflects an extension of Russia’s strategy to cut reliance on the western financial systems. This attempts to reduce the risk that accumulated gas revenues become subject to western sanctions in the future.