Announcements

Drinks

Scope analysis reveals European banks can cope with significant credit deterioration

Four banks – Svenska Handelsbanken, Swedbank, KBC and UBS – could even remain profitable with a tenfold increase in provisions. As a group, Nordic banks stand out as the most resilient to an asset-quality shock, thanks to their high pre-provision profitability coupled with a low level of credit risk.

German banks, conversely, look more vulnerable because they have relatively low pre-provision profitability and more contained capital buffers than European peers. But their profitability is on an improving path, and they are positively geared to increasing interest rates.

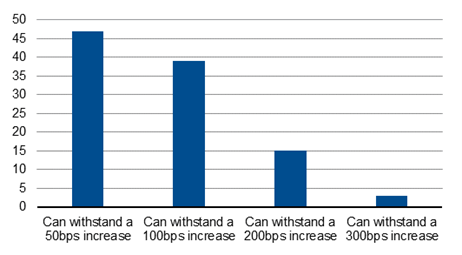

In its analysis, Scope also calculated how banks could cope with an increase in their loan provisions of 1% of RWAs. Against this metric, 39 of 50 banks would be able to absorb such an increase from ordinary profitability. Swedish banks again stand out on this account. In fact, SEB, Handelsbanken and Swedbank would still be profitable in the extremely unlikely scenario that loan-loss provisions increased by 300bp of risk-weighted assets.

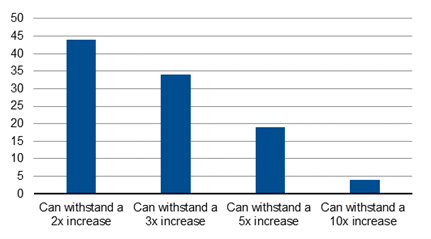

Most banks could absorb a 3x increase in provisions

LHS refers to number of banks

Source: Scope Ratings

Most banks could bear an increase in provisions of up to 1% of risk-weighted assets

LHS refers to number of banks

Source: Scope Ratings

“What our analysis shows is that European banks entered 2022 with strong balance sheets, including low levels of legacy NPLs, decent profitability and robust capital. We found that, with few exceptions, banks are well placed to withstand a deterioration in credit quality should this occur in the coming quarters,” said Marco Troiano, head of Scope’s financial institutions team.

Capital levels are strong: the median CET1 ratios of the 50 banks in Scope’s 50-bank analysis are well over 15%. “Buffers to capital requirements also remain large. If banks headed into the pandemic with buffers typically below 300bp, a more typical figure now is 500bp. This is well above the banks’ own targets, affording significant flexibility with respect to organic growth, M&A and capital distributions,” Troiano said.

Troiano expects the environment to remain supportive for bank credit, with the better interest-rate environment more than offsetting a mild deterioration in credit quality as growth softens. “The inflationary environment has many advantages for banks but is not free of pitfalls. Short rates moving from negative to zero will reduce the cost of excess liquidity held at central banks, while further increases in short-term rates will likely boost bank revenues, in particular for banks with large retail franchises. A steeper yield curve in general will support income from traditional banking activities,” he said.

“In an inflationary environment, banks’ cost management will be put to a test. This has been key in supporting profitability in recent years,” Troiano added.

Download the full report here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.