Announcements

Drinks

UK car finance: redress scheme will have modest impact on UK banks rated by Scope

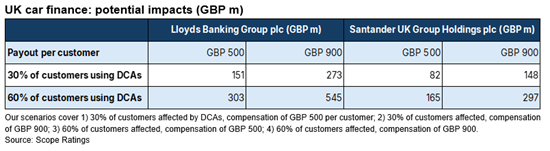

We have updated our four scenarios to estimate the potential impact on the banks in our rating universe most affected, using the size of banks’ car finance portfolios in 2020, an average price of GBP 14,600 per car and compensation within the amount estimated in August by the Financial Conduct Authority (FCA).

The cost to the banks will not exceed GBP 18bn, according to FCA estimates, but will not be materially lower than GBP 9bn either. The estimated amount of less than GBP 950 most individuals will probably receive in compensation (plus proposed interest per year of 1% over the base rate) is less than our November 2024 estimate of GBP 1,100-GBP 1,500 per customer. The FCA’s redress scheme to compensate motor finance customers who were treated unfairly, likely to be launched in 2026, will include discretionary commission arrangements (DCAs) but could also include non-discretionary arrangements.

The large banks we rate look well positioned to absorb compensation payments of this magnitude. The UK banks with major exposure to motor finance had an average RoTE of 12.8% in the first half of 2025, maintaining the encouraging performance of the recent past.

Even in a severely adverse scenario comprising stagnant loan growth, deteriorating asset quality, and compensation for car finance mis-selling, banks would remain profitable. In the worst-case scenario (Scenario number 4), Lloyds Banking Group would keep profitability above GBP 3.5bn with a return on average equity of around 8.5%, while Santander UK Group Holdings plc would achieve profits of around GBP 370m with a return on average equity of around 3%.

Lloyds has cumulatively booked GBP 1.15bn in provisions for operational/legal costs and customer redress since Q4 2023, including GBP 700m in 2024, equivalent to 16% of its annual profits. No new provisions related to this have been taken in 2025 so far. Santander UK booked a provision of GBP 295m related to historical motor finance commission payments in Q3 2024 results, equivalent to 31% of its 2024 net profit. The bank has not booked additional provisions since then.

See also: Car finance exposures will have moderate impact on UK banks rated by Scope.

Issuer rating reports available to ScopeOne subscribers:

HSBC Holdings Plc

Barclays Plc

Lloyds Banking Group Plc

Natwest Group Plc

Santander UK Plc