Announcements

Drinks

Germany’s gas squeeze: partial temporary solution takes shape to cutting Russian gas dependence

By Sebastian Zank, Marlen Shokhitbayev and Eiko Sievert

As policymakers in Berlin and executives at Germany’s energy-intensive companies wait to see if Russian state-controlled energy giant Gazprom will resume gas supplies through the Nord Stream 1 pipeline after this month’s maintenance shutdown (21 Jul 2022), the country’s plan for mitigating energy inflation, maintaining functioning energy markets and industrial output without over-burdening state finances is taking shape.

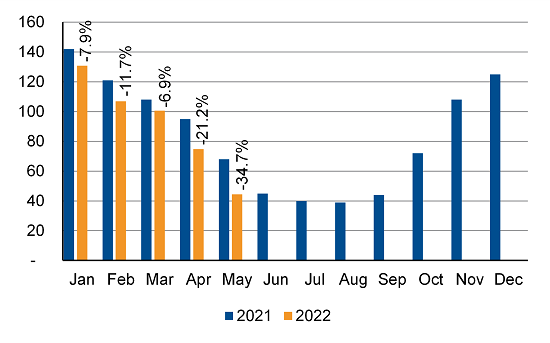

Central to it is letting record-high gas prices have the impact that they should in curbing demand. That is already happening, according to latest data (see Figure 1), though a self-imposed boycott of Russian energy products by some users and other incentives have played a role.

Figure 1: Monthly consumption of natural gas in Germany (in TWh) and YoY change

Sources: Scope Ratings based on BDEW data

Secondly, the German government continues to modify its emergency gas plan. Latest changes to the German Energy Security Act include two options for passing on increased gas procurement costs once the German regulator – Federal Network Agency (Bundesnetzagentur) – has determined that the country faces a gas shortage. One is through a price-adjustment clause for direct customers and the other is a levy to spread the burden of increased prices across all customers. Gas rationing remains an option too.

The government is also preparing speedier financial support for companies in the sector such as utility Uniper SE – its biggest single shareholder is Finland’s Fortum Oyj – which is under financial strain from its gas supply business which is having to meet demand with gas purchased on the spot market at around 10 times the price agreed in contracts in 2020-21. Uniper says it is losing a “middle double-digit million” euro sum a day. Other German utilities in a similar predicament are EnBW AG’s gas-importing unit VNG and Wingas GmbH.

However, the possibility of Russia halting gas supplies as part of its retaliation for Western support for Ukraine after Russia’s escalation of the war in February, or simply a prolonged reduction in gas supplies for the foreseeable future represent the biggest event risk facing the German economy this year.

Estimates of the impact on economic growth vary widely due to uncertainties around substitutability of energy sources for industrial processes. In principle, alternative energy sources could replace a significant proportion of natural gas usage by the industry sector. More than half of the gas used by the sector is for process heating and around 20% for electricity generation. In practice, adapting systems to use alternatives to gas needs significant investment and will take months at the least to put in place.

Judging what course Russia will take is difficult to predict. Stopping gas flows altogether is a one-time play as it would eliminate what shred of confidence German industry still has in Russia as a supplier.

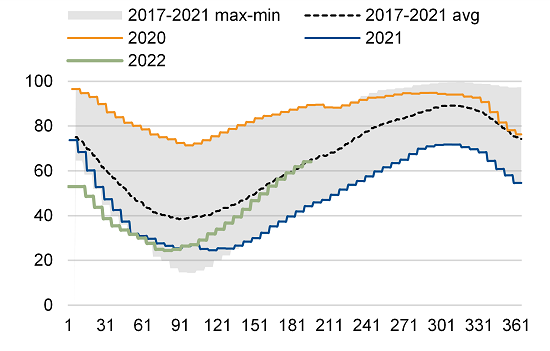

Whatever course of action the Kremlin takes, Germany remains highly vulnerable for now because, without Nord Stream 1 back in action, it would be near impossible to restore gas storage levels to 90% of capacity needed by 1 Nov. ahead of winter and to cover the 90-100 billion cubic metres of natural gas that Germany consumes every year. Gas storage is running this year barely in line with its five-year average (see Figure 2) despite the efforts this year to fill storage.

Figure 2: Germany’s faces winter gas storage shortfall

Running storage levels 2017-22 (% of full capacity)

Sources: Scope Ratings based on AGSI data

The prospect of inadequate gas in storage for the 2022-23 winter would be a strong signal for Europe’s gas markets, sending prices higher still.

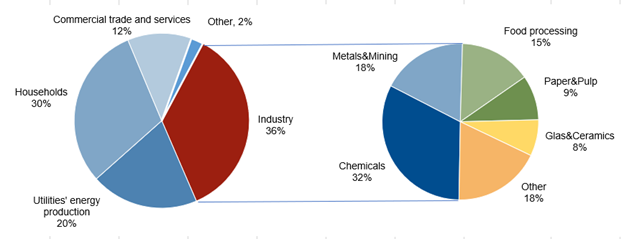

Using more coal to generate electricity rather than gas offers important but modest savings in gas consumption in Germany considering that a large portion is used for heating, with many sectors beyond industry still dependent on gas as i) an input factor and ii) for heat and electricity (see Figure 3). Particularly the chemicals industry (basic chemistry, rubber and plastics, specialty chemicals), companies in the field of metals production and processing as well as food processing companies would largely be affected by gas rationing as they cover more than 65% of industrial gas demand.

Figure 3: Gas consumption Germany 2020 by consumer group

Sources: Scope Ratings based on data from Arbeitsgruppe Energiebilanzen and BDEW

Whatever Russia’s approach to gas exports turns out to be, Germany has passed a point of no return in terms of the role of piped natural gas for the economy. The transition promises to be costly and difficult as the country faces several months of shortages and production halts. Until Germany is forced to declare the third stage of its emergency plan for gas, which would include targeted supply reductions for certain industry segments, rising prices will force consumers to reduce demand – slowly but surely.