Announcements

Drinks

European utilities: capex-heavy pursuit of decarbonisation tests credit quality; funding still ample

By Anne Grammatico, Associate Director, Corporate Ratings

The rise in capital expenditure has credit implications because the resulting cash outflow is not immediately compensated for by gains in EBITDA and cash flow from newly erected assets.

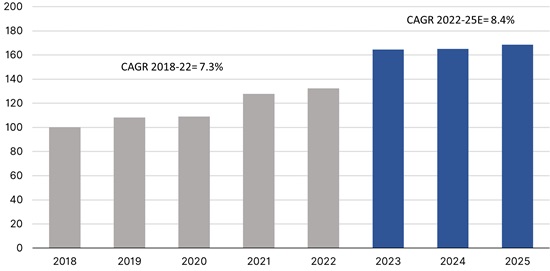

We expect aggregated capex for European power utilities (excl. grid operators) we rate to amount to EUR 75.6bn in 2023 before rising to EUR 75.9bn next year and to EUR 81.6bn in 2025. The increase is equivalent to a compound annual growth rate of 8.4% in 2022-2025, up from 7.3% in 2018-2022 (Figure 1).

Figure 1: Supercharged: European utilities’ capex runs at faster rhythm (2018-25E)

Index

Note: capex indexed, 2018 = 100. Source: Companies, Bloomberg consensus, Scope estimates

However, we expect the utilities to withstand near-term pressure on their balance sheets to fund the rise in capex without damaging their credit standing, with the help of asset sales and prudent financial policies.

First, there is ample liquidity for the utilities to tap on debt capital markets such is the appetite for investors for bonds, increasingly ESG-linked, from companies well known for reliable and predictable cashflow.

Secondly, credit pressures will ease in the medium term when the current heavy investment cycle has finished, returns from regulated assets catch up with higher interest rates, and the first revenues from new power-generation assets arrive.

Lastly, a large number of utilities are currently well supported by elevated operating cash flow from power generation and higher pricing as well as accrued cash reserves that have been built from solid earnings in power generation over the last two years.

Carbon intensity varies widely across European electricity sector

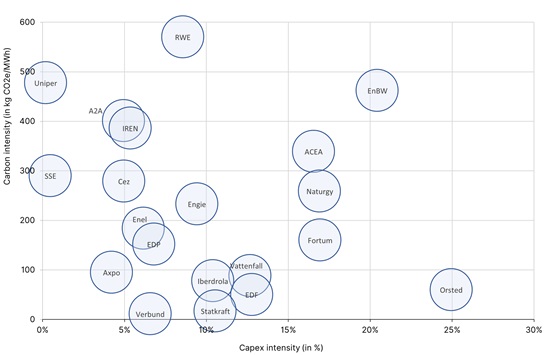

Our data shows that the degree of CO2 intensity of electricity generation in the sector diverges hugely, with some utilities facing relatively heavy capex in the short to medium term to catch up with rivals as regulatory pressure grows to meet net-zero targets in Europe. Among utilities with the largest carbon footprint are those in Germany, the Czech Republic, Poland and Greece, reliant heavily still on coal and natural gas, compared with those in France, Belgium, Switzerland, Austria, Spain and the Nordics with extensive nuclear, hydroelectric, solar and wind generation.

Similarly, the utilities’ capital commitments, measured in Figure 2 by capex as a proportion of revenues, vary significantly, reflecting different business models – by fuel source and by activity (generation, distribution and retail) – but also different degrees of past investment in renewables, leaving some with catch-up spending to undertake. This is particularly the case for some of Italy’s utilities.

Figure 2: Comparing CO2 and capex intensity among selected European power utilities (2022)

Source: Company reports, Scope

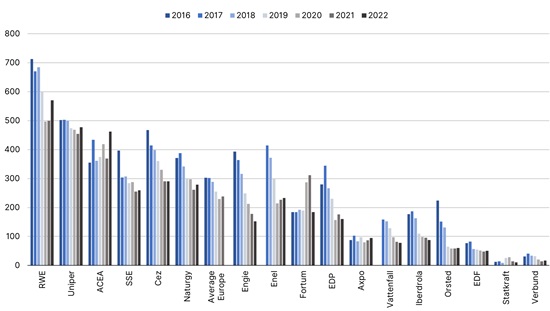

Geopolitical-linked pause in sector’s decarbonisation in 2022

The sharp rise in oil and gas prices, in 2021, made worse by the repercussions of Russia’s intensified war in Ukraine, has focused the attention of utilities on the urgency of diminishing reliance on fossil fuels and improving the security of their energy supplies.

The sector’s CO2 intensity rose in 2022, interrupting the steady decline since 2018, as interruptions in supplies of natural gas related to Russia and nuclear-power generation (maintenance in France) contributed to a rise in coal-fired power generation.

Figure 3: Footprints small and large: CO2 intensity of electricity generation, selected utilities

(kg CO2e/MWh)

Source: Company reports, Scope

Utilities retain ready access to market funding

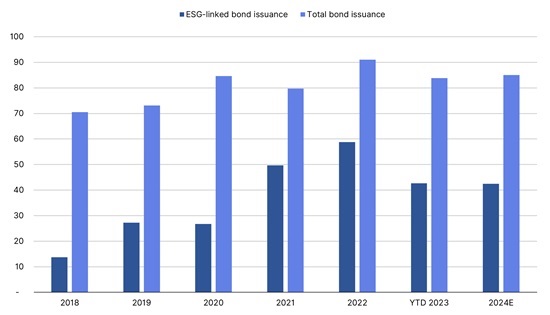

Debt capital markets are, at least for now, readily absorbing the bond issuance related to the utilities’ increasing capex, whether related to investment in more low-carbon generation capacity or, for grid operators, transmission/distribution networks capable of handling heavier loads of intermittent energy supply.

The volume of total bonds issued by European utilities has risen steadily since 2018, with sector relatively active despite the slump in non-financial corporate bond issuance this year amid rising interest rates.

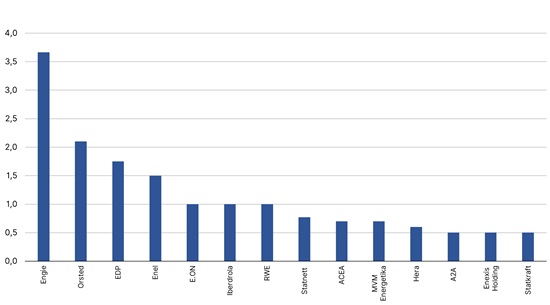

Utilities will again be one of the main contributors to green-bond and ESG-linked bond issuance this year. French’s Engie SA issued a total of EUR 3.7bn in the first half of 2023. Denmark’s Orsted A/S has issued EUR 2.1bn.

We expect more utilities to come to market with capex-related fund raising. The lower amount of ESG-linked bonds in YTD2023 could partly reflect the disappearance of the green premium, or “greenium,” but also higher interest rates.

We expect likely stable volumes for ESG-linked and total bond issuance in the sector in 2024.

Figure 4: European utility bond issuance is on the rise, but growth in ESG-linked deals stalls

EUR bn (2018-2022, 2023 YTD, 2024E)

Source: Bloomberg, Scope estimates

The prospect that the utilities will gradually improve their business risk profile through the growing investment in renewable-energy assets – profitability should increase and exposure to danger of stranded assets should diminish – is sustaining investor appetite for the sector’s debt issuance.

Electricity utilities with higher proportions of cheap renewable-energy generation will also benefit from a better position in the merit order in Europe’s power markets, in which power stations offering the cheapest electricity are used first to feed into the power grid.

To be sure, the capex and funding challenge varies greatly between different European utilities. Compare the hefty capital expenditure at Électricité de France SA mostly related to maintaining its park of more than 50 nuclear power plants. The utility has ambitious plans to build new power stations.

High capex at Spain’s Iberdrola SA, in contrast, reflects its ambitions to further develop its extensive renewable-energy business.

At Enel, where more than half of its power production comes from non-renewable energy, management needs to invest more in renewable energy to catch up with the rest of the European sector and meet its net-zero targets despite hefty recent spending.

Figure 5: Engie, Orsted, EDP led ESG-linked bond issuance in H1 2023

EUR bn

Source: Bloomberg, Scope

Need for some carbon-intensive operators to increase low-emission capex

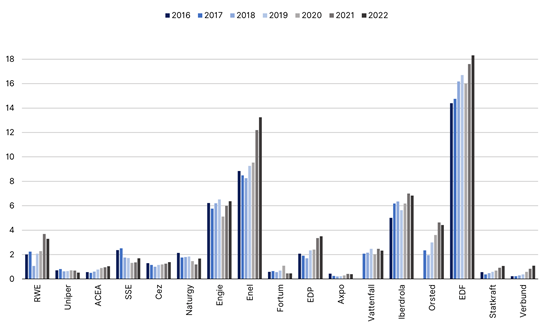

One indication of the scale of the utilities’ investment challenge in Europe is that some companies with the most carbon-intensive activities still have comparatively low levels of capex as a percentage of revenues (Figure 2, 6). In 2022, utilities with carbon intensity higher than 250 kg CO2 e/MWh tended to have low capex intensity, ranging from 0-5%.

Some of these carbon-intensive utilities have begun ramping up investment in low-emission activities. One example is Italy’s Acea SA, mainly invested in regulated network activities. Another is Spain’s Naturgy SA.

We can expect an increase in capex intensity in the coming years to reduce these utilities’ above-average carbon footprint, with Italian utilities among those set to make a sharp improvement. Otherwise, utilities which miss the opportunity to invest will become lose further ground against the industry’s leaders even if this temporarily burdens free cash flow and discretionary spending such as shareholder remuneration.

Figure 6: Capex 2017-2022 at European utilities ranked by carbon intensity of their activities

EUR bn

Source: company reports, Scope

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.