Announcements

Drinks

Europe hybrid bond market: issuance to steady after strong but partial rebound to EUR 20bn in 2023

By Azza Chammem, Associate Director, Corporate Ratings

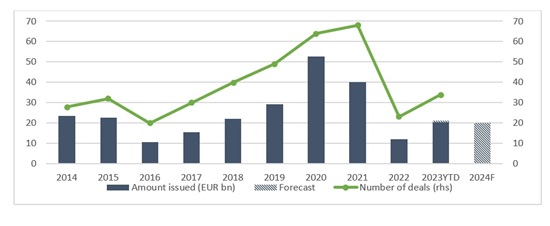

Issuance rebounded to more than EUR 20bn from last year’s EUR 12bn, though still significantly below the high levels of 2020 and 2021. The recovery in hybrid deals underlines the segment’s emergence as a small but important part of Europe’s capital markets, particularly for issuers in capital-intensive industries such as utilities and telecommunications companies. Deals from these two sectors represent 66% of issuance volumes so far this year.

We expect a similar overall volume for 2024 and 2025. Many issuers face first call dates in 2024, equivalent to around EUR 28bn in outstanding hybrid bonds, while in 2025, issuance with first call dates stands at another EUR 34.6bn.

Figure 1: European corporate hybrid bond issuance 2014-2024F

Source: Bloomberg, Scope

Higher coupons deter some but far from all issuers

The dilemma that issuers face on whether to call a hybrid issue remains as acute as ever. As credit spreads have widened in the past two years, deciding not to call can make more sense in theory for a corporate issuer than paying the elevated coupon on a new hybrid bond or alternative fixed-income security. However, in practice, only a minority of issuers took that route this year, with the notable exception of real estate companies.

Frequent issuers tapped the market, aware of the reputational risk of not doing so and the consequences of losing 50%-equity treatment of hybrid debt granted by rating agencies if they replaced hybrids with conventional loans or bonds.

Indebted companies with limited financial headroom tend to opt for continued hybrid bond issuance even with a higher coupon to ensure that they maintain leverage ratios, even though that comes at the cost of diminished interest cover. Unless a hybrid-debt issuer has significantly strengthened its balance sheet since the original placement of the securities, the company typically replaces the called and redeemed instrument with another hybrid bond. Keeping leverage under control is typically more important for retaining a rating than maintaining high interest coverage ratios which are usually still solid after the era of low record-low interest rates.

Issuance from real estate sector dwindles

Still, the past two years are a reminder that as tempting as it is to enter the hybrid bond market when market conditions are good, issuers need to recognise that keeping investors satisfied and willing to invest in successive round of hybrid issuance can involve paying higher coupons when market conditions deteriorate.

This year, tighter financial conditions in Europe have weighed particularly heavily on the interest-rate sensitive real estate sector – marked by some high-profile insolvencies and credit rating downgrades – with a corresponding impact on the hybrid issuance from property companies.

Real-estate sector hybrid issues largely dried up with the increase in extension risk, namely the concern among investors that an issuer doesn’t exercise the right to call on the first call date.

Luxembourg-registered Aroundtown SA and Grand City Properties SA skipped first calls while there was as coupon deferral at Sweden’s SBB i Norden AB and the related investment holding IB Invest AB. One notable exception was Unibail-Rodamco-Westfield SE which did tap the hybrid bond market.

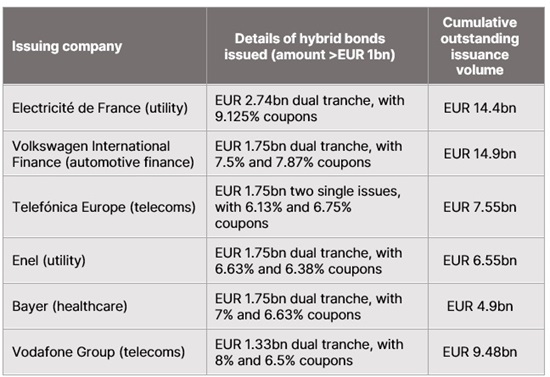

Issuance in 2023 concentrated among few companies

The European companies which have in the past been the most active issuers of hybrid bonds again led issuance volumes in 2023. Ten of the top 15 issuers, holding around 30% of cumulative outstanding issuance volume, have turned out to be the most active in the market this year (Figure 2).

Figure 2: Leading hybrid bond issuance in 2023 to date

Source: Bloomberg, Scope

Electricité de France SA, a frequent hybrid issuer, placed the largest corporate hybrid bond to date this year, a EUR 2.74bn dual tranche. The next biggest issue after the French nuclear-power utility came from Volkswagen AG. In total, six companies have issued more than 50% of the overall amount this year.

Even strong investment-grade issuers had to pay generous coupons with higher in interest rates and changed market expectations. Volkswagen offered more than 7% for its coupons on its 2023 issues compared with around 4% in 2022.

Why is the hybrid bond market attractive to investors?

Hybrids are more popular when market sentiment is benign. At times of turbulence, investors tend to refrain from taking the risks of buying subordinated debt instruments where payment of coupons and even the principal can be deferred at the discretion of the issuer.

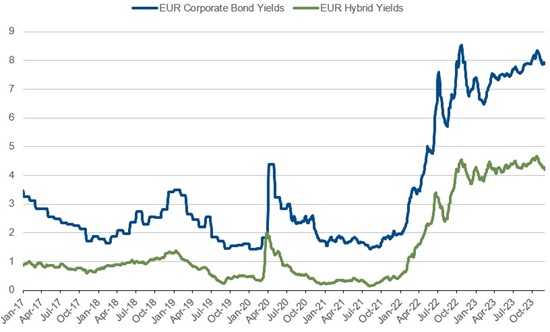

Hybrid bond yields are quick to reflect this extra risk when market sentiment sours, making it more sensible for companies to issue corporate bonds if they need extra capital-market financing. However, hybrid issues this year encountered strong demand, due to the attractive yields and the investment profiles of the companies issuing the bonds.

Credit spreads widened to the benefit of investors (Figure 3). Frequent hybrid issuers are often investment-grade companies and a large portion of the year’s deals were in defensive sectors such as utilities and telecoms.

Figure 3: Yields on non-financial corporate bonds, hybrid bonds diverge

(%, 2017-2023 YTD)

Source: Bloomberg

For a risk-averse investor, hybrids can offer an attractive combination of low risk, as default is unlikely, and high return, due to the premium attached to subordination plus deferral and extension risks. And in times of economic instability, investors tend to be selective, opting for defensive sectors.

Outlook for 2024: high refinancing costs to weigh on issuance

Looking at the volumes due to be called in 2024 and early 2025, we can expect issuance volume to be around the EUR 20bn issued in 2023. To be sure, there are increasing signals that the interest rate cycle has peaked or is close to doing so judging by recent guidance from US Federal Reserve and European central banks. However, even if the European Central Bank itself were to start cutting rates in 2024, refinancing costs will likely remain high and are unlikely to return to pre-2022 levels soon.

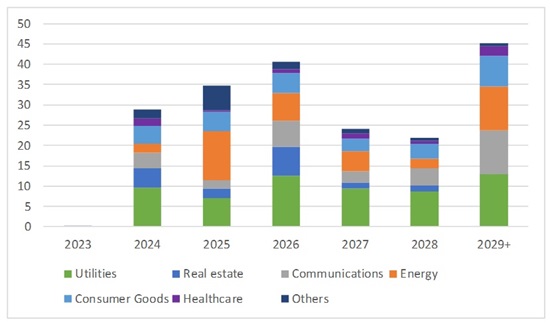

There are around EUR 195bn in outstanding hybrid bonds in Europe to be redeemed and replaced in the next few years. Judging by the upcoming first call dates of outstanding hybrids, utilities and telecoms companies will again be among the most prominent issuers to seek refinancing over the next few years. As real estate issuers face continued financial pressure, we may see a series of “no calls” in 2024 and 2025.

Figure 4: Outstanding hybrid issues according to the next call date

(EUR bn)

Source: Bloomberg, Scope

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.