Announcements

Drinks

Covered Bond Outlook: Back to a credit-driven buyer’s market

“We are definitely back in a buyer’s market,” said Karlo Fuchs, head of covered bonds. “The focus is back on credit so the quality of issuers, cover pools and market risks will all drive more spread differentiation than we have seen in recent years. Particularly for the real-money investors who have returned to the fray, attracted by European covered bond spreads that by the end of 2023 had risen their second highest levels since the Eurosystem started its asset-purchase programmes in 2014.”

Euro benchmark issuance expectations for 2024 remain solid. “Volumes of EUR 160bn-EUR 170bn will be driven by rolling benchmark maturities of around EUR 110bn, expected rate cuts and more focus by banks on optimising funding costs using covered bonds rather than achieving MREL targets,” Fuchs said. “The geopolitical and economic backdrops will remain volatile but these could support covered bond issuance given the instrument’s safe-haven status.”

Uncertainties around issuance projections include the ECB’s monetary stance and actions around its EUR 285bn in covered bond holdings, banks’ unwinding of EUR 396bn in TLTROs, and any decision about the level of minimum reserves banks need to hold.

“With regard to the environmental quality of buildings, 2024 could mark a turning point,” said Mathias Pleissner, deputy head of covered bonds. “The agreement between the Councils of the European Parliament and Union on the Energy Performance of Buildings Directive (EPBD) will put pressure on the valuations of less energy-efficient housing and commercial real estate and will fuel the need for renovations to increase Energy Performance Certificate (EPC) scores.”

On house price trends, Pleissner pointed to surprisingly robust residential prices: +0.8% in Q3 2023 and +1.3% on a one-year view. “But while average European house prices appear to be holding steady, performance between countries is diverse,” Pleissner cautioned. Since the beginning of the higher rate cycle in 2022, prices have fallen in only six countries of the EU + Switzerland/UK. Luxembourg, Germany, Finland, Sweden and Denmark are the only countries to have seen house price corrections.

We do not think that developments in European mortgage markets have peaked. Prices are expected to continue falling moderately, especially where long-term house price growth substantially exceeds long-term economic growth. This is the case for Austria, Norway and Luxembourg (7x), Switzerland and Portugal (5x) and France and Sweden (4x). At the same time, high demand for housing persists, reinforced by reduced building activity.

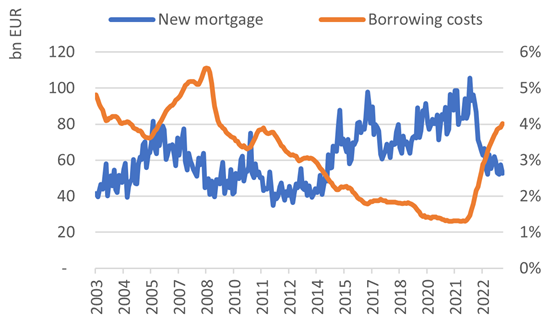

“New building activity halved last year from its peak in March 2022 as a direct reaction to rising interest rates,” Fuchs noted. “Higher rates also impacted the volume of household loans for house purchases, which stagnated but did not decline as they did in 2014 or 2009. Yet. Given that interest rates are widely believed to have peaked and house prices have softened, we expect an uptick in mortgage lending in 2024.”

New mortgages vs. borrowing costs

Source: eurostat, Scope Ratings

On the basis of systemic risk around mortgage lending based on each market’s leverage, prevailing interest-rate types and house price sustainability, we have identified Sweden, Netherlands and Norway as high risk. All have relatively high owner-occupied property markets and at least 75% of homeowners have mortgages. Sweden and Norway also come out as high risk on debt to income and exposure to floating-rate mortgages

Regarding the sustainability of house prices comparing long-term house price trends to long-term GDP growth, Sweden and Norway stand out, alongside Austria, Luxembourg, Portugal and Hungary. Taking all factors into consideration, the highest risk to mortgage markets is in Norway followed by Switzerland, Sweden, Luxembourg and Portugal.

“This should not necessarily start to ring alarm bells, though, as most countries have macroprudential measures in place targeting financial stability,” Pleissner said.

Download the 2024 Covered Bond Outlook here.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.