Announcements

Drinks

Spain’s fiscal challenges persist amid political impasse; weak productivity remains economic concern

By Jakob Suwalski and Brian Marly, Sovereign and Public Sector Ratings

Spain (A-/Stable) is expected to reach a budget deficit of 3.9% of GDP in 2023, below our last forecast of 4.0% of GDP, bolstered by tax returns from a resilient economy. However, the Senate's recent rejection of fiscal targets for 2024 has led to a delay in approving a new budget, potentially slowing down the momentum needed for reforms aimed at enhancing the economy’s growth potential.

Spain aims to reduce the deficit to 3% by 2024, a 7pp reduction from a deficit of 10.1% in 2020. However, achieving this target may prove challenging due to elevated interest rate expenses. In addition, the minority government needs to pass the budget which reconciles EU fiscal rules with opposition calls for tax reductions and increased regional funding. This dilemma places added strain on central-government finances, given the additional fiscal leeway already granted to the regions. We expect the government to proceed with the budget after a second vote in Congress.

Economic momentum continues…

The near-term repercussions of the budget stand-off are mild for now as the Spanish economy is performing better than expected. Spain’s GDP growth of 2.5% in 2023, well above the EU average of an estimated 0.5%, slightly surpassed our expectations after a strong Q4, when output rose 0.6% from the previous quarter, above the 0.5% average of the previous five quarters.

We have revised our forecast for growth this year up to 1.9% from 1.8% given continued economic momentum, with activity levels stable in the first two months of the year. The government has based its 2024 budget on an assumption of growth of 2%.

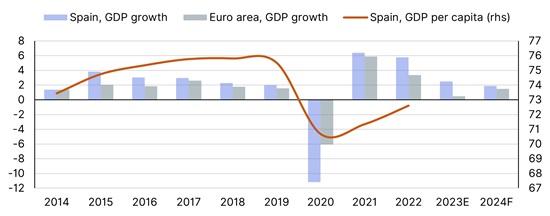

Figure 1. Spain’s economy outperforms euro area; per capita GDP growth remains weak

year-on-year, % (lhs); % of euro area average (rhs)

Note: Figures for 2023-24 euro area GDP growth and 2023-24 Spanish GDP- corresponds to the European Commission’s latest forecast. Figure for 2024 Spanish GDP growth corresponds to Scope’s latest forecast. Sources: Eurostat, European Commission, Scope ratings

…but concerns remain about Spain’s productivity gap

Spain has relatively lower productivity and per capita incomes compared with other advanced economies, representing keys constraints on its sovereign rating and highlighting the need for structural reforms to enhance sustainable economic growth.

While Spain’s economic growth has been robust in recent years, productivity gains have trailed peers. Labour productivity, as measured by GDP per person employed, stood at about 82% of the euro area average as of 2022, behind France (111%) and Italy (97%). Spain's per capita GDP remains about 25% below the euro area average (Figure 1).

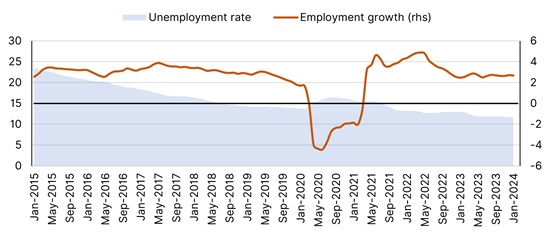

Figure 2. Labour market improves, but reducing high unemployment still a challenge

Seasonally adjusted unemployment, % (lhs); year-on-year change, % (rhs)

Sources: Eurostat, Spanish Ministry of Labor, Migration & Social Security, Scope ratings

Spain's persistent income gap compared with other large euro area economies is driven in part by its disproportionate reliance on low value-added sectors, such as hospitality services, despite competitive advantages in industries such as motor vehicle manufacturing, banking and transport services. In addition, despite strong job creation recently, unemployment remains high at 11.6% (Figure 2) and above the euro area average of 6.4%, curbing corresponding gains in purchasing power.

Spain’s growth potential in line with or below that of similarly rated EU peers

These factors constrain Spain’s growth potential, which we estimate at 1.75% a year, below similarly rated EU countries such as Slovenia (A/Stable, 3.0%), Lithuania (A/Stable, 2.5%), Latvia (A-/Stable, 2.5%), though in line with Portugal (A-/Stable, 1.8%) and above Italy (BBB+/Stable, 1.0%).

Raising Spain’s growth potential in line with the investments and reforms outlined in Spain's Recovery Plan, will be key to help the country meet growing fiscal pressures, in particular those related to the country’s ageing population. Concerns remain about the sustainability and effectiveness of the pension system in Spain despite recent reforms. A 2023 report from independent fiscal watchdog AIReF estimated that public spending on pensions would rise to 16.2% of GDP by 2050, up from an already-elevated 13.6% in 2021.

Spain's public finances, with a still-elevated fiscal deficit and high public debt burden of 107.7% of GDP at end-2023, which we estimate to remain broadly stable over coming years, will become more resilient through measures that sustain economic growth and alleviate the upward pressures on public spending. Therefore, it is crucial for the government to pursue a consensus-building approach to make progress on reforms that sustain GDP growth.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.