Announcements

Drinks

Strategic case for Western European banks in CEE remains intact

The war in Ukraine has not dented business appetite. Profitability at Western banks’ CEE subsidiaries reached record levels in 2023 due to the combination of high interest rates and a benign risk environment. The banks are well placed to overcome risks in CEE domestic markets this year.

“When evaluating the long-term strategic drivers of Western European banks’ presence in CEE, three elements stand out: growth optionality, structurally high profitability, and diversification,” said Milya Safiullina, a bank analyst and author of a report out today. “CEE markets typically offer high return potential compared to Western Europe and provide a valuable earnings boost for banking groups invested in the region.”

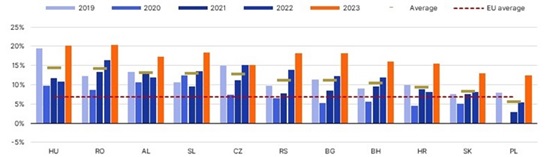

Return on equity in CEE countries

Note: EU and country averages based on 2019-2023. BH: latest data as of Ha 2023. Source: IMF, national banks’ data, EBA, Scope Ratings

“From a diversification perspective, being present in CEE can add stability to the performance of Western European banking groups because CEE and Western European economic cycles and profit streams are not fully correlated,” Safiullina continued. “For highly capitalised institutions in mature markets with limited potential for volume growth, the ability to deploy excess capital profitably to meet demand for credit is a valuable strategic option.”

While lending in the region will rebound this year as borrowing costs decline and economic activity accelerates, there are some downside factors, including strong competition and potential margin compression over time. Another headwind this year is the size and timing of expected rate cuts and pressure from windfall bank taxes in several countries. The need to issue debt for MREL purposes and higher risk premiums for new issues will also weigh on net interest income.

Being present in CEE comes with risks naturally associated with banking in less mature markets, notably political and legal risks, notwithstanding geopolitical tensions. The introduction of extraordinary windfall taxes to finance public expenses in several countries, interest-rate caps on certain loans in Hungary, credit holidays on FX-related loans and restrictions on banks paying dividends in Poland are examples of recent government intervention. “Policy uncertainty weighs negatively on our assessment of the operating environment for banks in these countries,” Safiullina said.

Although non-performing loans levels in CEE are generally elevated, risk adjusted return remains attractive. “Weaker asset quality compared to Western Europe is mitigated by higher margins, allowing higher risk costs to be absorbed. Capital adequacy in CEE banking sectors remains sound, despite ongoing geopolitical turbulence and increased capital requirements in some CEE countries.”

Banks are looking to exploit the growth potential in CEE markets, looking for M&A or portfolio acquisitions, as demonstrated by M&A activity in Hungary and Romania by Erste Bank, UniCredit and Intesa Sanpaolo. “Bank M&A in CEE has been active and we expect further consolidation in the region because regulatory pressure, digitalisation, cost and margin optimisation efforts and new bank taxes will erode profitability,” Safiullina said.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.