Announcements

Drinks

BPCE’s acquisition of Novo Banco is a step towards greater European Banking Union

By Marco Troiano, Financial Institutions

Unlike other recently announced or potential transactions, where the bidder already had a presence in the target’s domestic market, BPCE has no pre-existing commercial footprint in Portugal, which makes the acquisition an interesting case of strategic market entry into a new market.

Rather than cost synergies, the deal is driven by the strategic pursuit of diversification outside of BPCE’s home market, in line with the group’s broader European expansion strategy, following recent transactions in equipment finance and asset management. It will test the potential to leverage the group’s retail and SME expertise to grow in a relatively small but competitive market.

Following the recent setbacks of cross-border bank M&A deals, BPCE’s announced deal is a welcome development. It shows a continued willingness by some European banks to look beyond their home markets, despite the still-incomplete European Banking Union, which continues to constrain the immediate financial advantages of operating a banking group across borders.

Alongside UniCredit and Erste Bank, BPCE is emerging as one of the most active banks in pursuit of international expansion in 2025. While the former two have a long history of cross-border M&A and have been positioning their groups as European – and especially CEE –champions, this has not been the case in the past for the French mutual group.

In and of itself, the acquisition is hardly transformational for BPCE. We estimate the Portuguese perimeter will account for roughly 3% of the group’s total exposures (including off-balance-sheet exposures). But it will be BPCE’s second retail market and offer a platform for further growth given the significant deleveraging and asset-quality clean-up of the past decade.

It could also prove a blueprint for further inorganic expansion. The financial impact of the transaction is likely to be manageable, in the context of BPCE’s significant excess capital. The group expects its consolidated CET1 capital to remain above 15% on completion of the transaction, a comfortable buffer to the 10.6% requirement as of Q1 25.

Strategically, the acquisition underlines the value of geographic diversification, a key element driving our business-model assessments. Diversification, especially in markets with low correlation to home markets, supports the resilience of financial performance against idiosyncratic economic shocks.

Strong foreign owners will help to maintain banking competition in Portugal

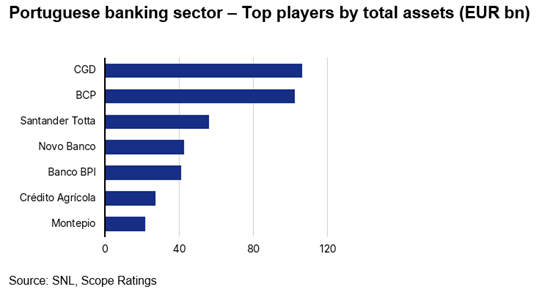

BPCE joins CaixaBank and Santander as major owners of Portuguese banking assets (BPI and Totta, respectively), which together control about one quarter of the Portuguese market in terms of private-sector deposits.

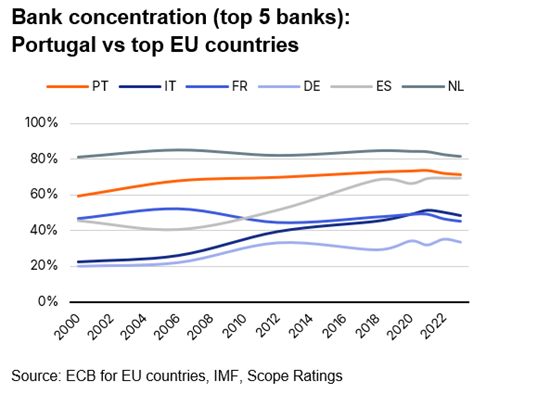

The Portuguese banking sector is one of the most consolidated in Europe. The top five banks control over 70% of total banking assets. Caixa Geral de Depósitos (state owned) and Banco Comercial Português (BCP), the two largest banks, control more than 30% of customer loans and roughly 40% of deposits respectively.

We do not expect the Portuguese government to oppose the deal, as the transaction involves a transfer between two foreign owners. Nor do we anticipate challenges from a competition standpoint, considering BPCE has no pre-existing franchise. Rather, a Novo Banco with a well capitalised industrial shareholder may prove a force for greater competition in the Portuguese market.

See also:

- UniCredit: Large M&A setbacks will not curb strategic ambition

- French banks quarterly: favourable earnings trajectory challenged by fragile economic recovery

- UniCredit: Commerzbank takeover unlikely without German government approval; BBVA’s Sabadell bid reflects solid prospects for Spanish Banking sector.

- BPCE’s joint venture with Generali supports business diversification and profitability