Announcements

Drinks

Euro area inflation pressures balanced; higher long-end yields a concern

By Dennis Shen, Scope Macroeconomic Council

Monetary accommodation is still working its way through the euro area economy following rate cuts between June 2024 and June 2025. The recent trading agreement between the US and the EU has reduced pressure to lower rates, while the re-direction of cheap goods from China and elsewhere because of higher US tariffs is likely to trim prices in the short term. Meanwhile, the euro’s appreciation against the dollar and other currencies is dis-inflationary.

But inflationary pressures could intensify in the medium term. Core and services-sector inflation and wage growth are off their highs but remain above target. Labour markets remain tight, pushing prices higher; increased public spending in Germany and across Europe (including on defence and infrastructure) is exerting inflationary pressure; while the new EU energy trading regime taking effect in 2027 is also expected to raise prices. Our inflation forecast is 2.1% for this year and 1.9% in 2026, compared to 2.4% last year and 5.4% in 2023.

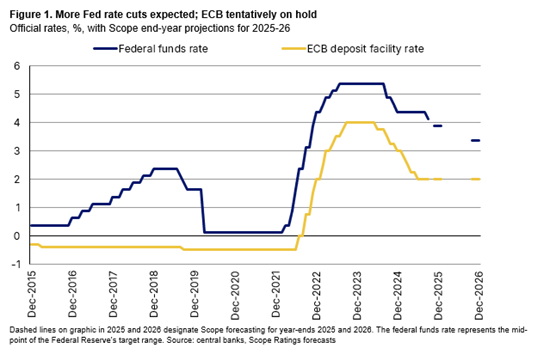

We do not expect any further ECB rate cuts this year, but the ECB will keep its options open. The bias late this year or next year is towards easing rather than tightening. The next change of the deposit rate from its current 2% will hinge on inflation dynamics, US-EU trade relations, the economy’s growth trajectory and the exchange rate. The euro has strengthened 14% against the dollar this year.

Any move significantly above 1.20 against the dollar could provoke concerns around deflation risks and competitiveness. As the main alternative reserve currency to the dollar, the euro has benefitted from the uncertainties around US trade and fiscal policy and a deliberate US strategy to devalue the dollar for re-balancing trade.

Another factor that may become increasingly crucial is US policy. The resumption of US rate cuts plus market and political pressure for more easing may put increasing pressure on the ECB if diverging rates between the US and the euro area sustain euro appreciation (Figure 1). If left unchecked, a stronger euro may further undermine inflation, potentially pushing it below target and forcing the ECB to respond.

Higher long-end yields and the effects of higher rates

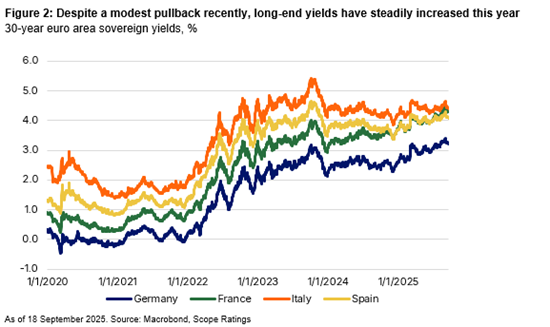

Our baseline has long been higher rates for longer, underscored by the recent rise in long-term euro area yields, which ought to be a concern for the central bank (Figure 2). If further US rate reductions de-anchor long-run inflation expectations, long-term yields may increase further, resulting in steeper yield curves.

Still, the ECB is unlikely to take significant action in the near term against such developments, given that higher long-term yields represent legitimate market concerns about the longer-run inflation outlook amid expansionary budgetary policy, increasing government debt and political instability in France.

Activation of the Transmission Protection Instrument appears unlikely in the near term unless turbulent French politics result in a much more aggressive sell-off in French government bonds. Any scenario of a significant cross-country increase in yields challenging monetary transmission could prompt a response, such as slowing the pace of quantitative tightening.

Higher rates present a risk to our outlook for global credit, by challenging debt affordability and curtailing market access for vulnerable borrowers. A steeper yield curve incentivises public and private-sector borrowers to access credit at the short-to-medium end of the yield curve, which increases roll-over and interest-rate risks.

The Scope Macroeconomic Council brings together credit opinions from ratings teams across multiple issuer classes: sovereign and public sector, financial institutions, corporates, structured finance and project finance.