Announcements

Drinks

Utilities credit outlook: slightly positive, favouring power generators vs grid/network operators

By Sebastian Zank, Managing Director, Corporate Ratings

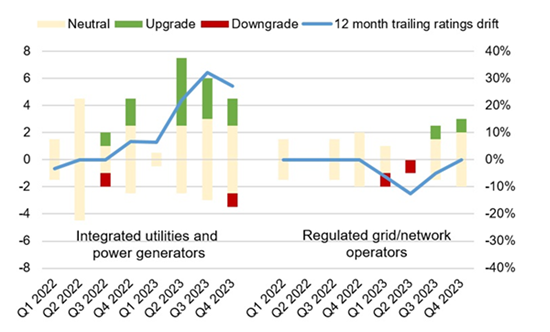

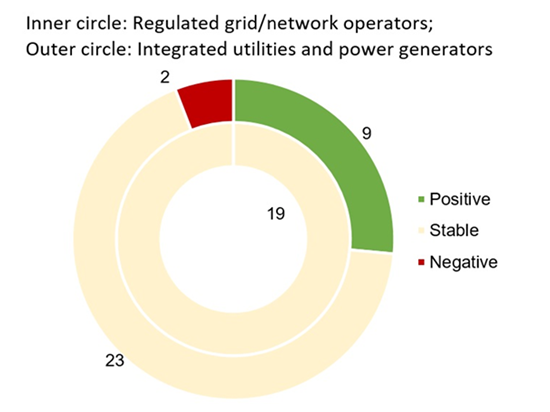

The favourable ratings drift witnessed last year has further to run as displayed by a wide range of Positive rating Outlooks. Underpinning the improvement in credit quality are above-average power prices and ample operating profit margins.

Regulator tailwinds provide relief from pressure on grid/network operators’ credit outlook

For regulated grid/network operators, the downward pressure on credit ratings will likely diminish compared with the past two years. Grid operators have largely determined the action they need to take to maintain credit quality in the face of continuously rising capital expenditure. The catch-up on unearned revenues from previous years, increasing regulated tariffs and the likely peak in the interest-rate cycle provide favourable tailwinds – at least in terms of preserving current credit ratings. (Figures 1, 2)

Figure 1: Contrasting ratings drift for integrated utilities/power generators vs grid/network operators|

(Scope rating actions by quarter, 2022-23)

Source: Scope Ratings

Figure 2: Further ratings upside on power generators as signaled by Outlook distribution, YE 2023

(number of ratings)

Source: Scope Ratings

Continued above-average prices to benefit lower-cost power producers

Prices for energy commodities have fallen from their peaks in 2022, but we are still far away from a normalised market, providing the backdrop for stable if not improving credit ratios for integrated power utilities, particularly those with lower-cost production.

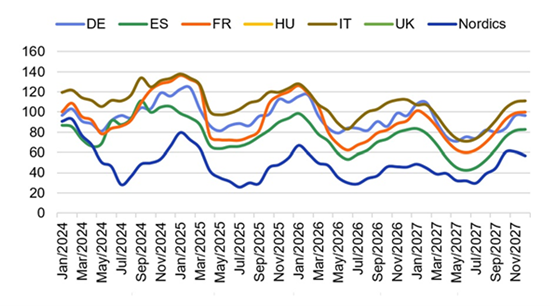

Electricity prices across major European markets remain more than two times as high as they were before Russia’s escalation of its war in Ukraine nearly two years ago. Utilities regularly hedge a large part of future generation volumes either on energy exchanges or through bilateral contracts, a practice which now ensures favourable pricing for 2024 and beyond. Favourable futures prices for 2024 and beyond (Figure 3) as well as the scale of and prices for hedging volumes for electricity generation at the largest European utilities (Figure 4) provides ample evidence of the tailwinds for European electricity suppliers.

Lower prices for a large segment of European utilities will materialise only in the medium term as things stand. Indeed, any escalation in geopolitical tensions, affecting energy-commodity rich countries and/or disruptions in the supply of coal and gas to Europe, with repercussions for energy markets would delay the return to normalised energy prices. Governments might have to step in again to cushion the impact on households and business with price caps.

Figure 3: Wholesale electricity forward prices in major markets well above historical averages at YE 2023 (EUR/MWh)

Source: Bloomberg, Scope Ratings

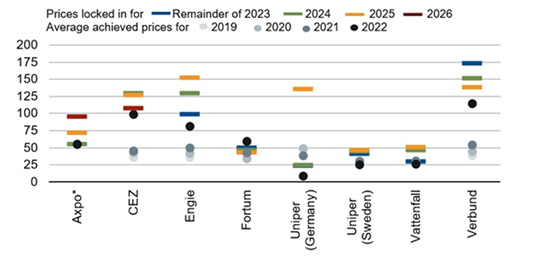

Price hedges for 2024 have largely been closed during 2021-2023 based on elevated wholesale prices and price expectations on gas procurement, which is still the dominant factor when setting prices in the merit order. As such, contracted prices range between 45-150 EUR/MWh as reported by large European incumbents, which is well above the historical average of 20-50 EUR/MWh. Such a price environment provides for solid margins and cash flow support for utilities, which operate a large portfolio of low-cost generation capacities such as renewables including hydro and nuclear, most notably in the Nordics, France and Switzerland. However, the picture is bleaker for utilities largely dependent on coal- and gas-fired power plants, but much depends on prices for commodity procurement, notably coal, gas and CO2 certificates.

Figure 4: Hedged electricity prices for major European power generators well above historical prices (EUR/MWh, as reported in the latest quarterly update)

* Axpo has an end-Sept. financial year, so hedging ratios shown for 2023/24, 2024/25 and 2025/26

Sources: companies, Scope Ratings

The sector is also less exposed than it used to be to volatile market conditions. Most utilities with exposure to power supply have implemented strategies over the past few years to synchronise procurement and selling prices, thereby ensuring slightly positive wholesale and retail margins. However, there are still some utilities with still poorly hedged procurement and customer pricing still accruing operating losses. After considerable disruption in the past three years, the power-supply segment is now stabilising. Many pure-play suppliers in liberalised markets such as the UK, Germany and Italy have been crowded out of the market since 2021 by rivals with more flexible pricing strategies or stronger balance sheets. Integrated utilities that incurred operating losses in supply have offset them with solid earnings in other business segments. Overall, exposure to energy supply should not adversely impact corporate balance sheets as happened in the past three years.

Utilities face mounting capex related to Europe’s energy transition

Europe’s utilities face growing pressures to invest more heavily in taxonomy-aligned assets that accelerate the energy transition while contending with continued pressure on profit margins in conventional fossil-fuel based power generation. The EU’s updated Renewable Energy Directive of November 2023 has raised the bar for the proportion of electricity derived from renewable sources to a minimum of 42.5%, up from 32%, by 20301. This implies about a doubling of the share of renewable-energy output over the next seven years.

To meet this target, utilities will have to invest more in low-carbon generation capacity in addition to power grids to ensure the networks can cope with greater loads of intermittent electricity -- and transport it over longer distances. Investments in renewables and grids are scheduled to make up around three quarters of all capex for integrated utilities, bringing the capex exposure of these two segments to around 80-85% of the whole sector.

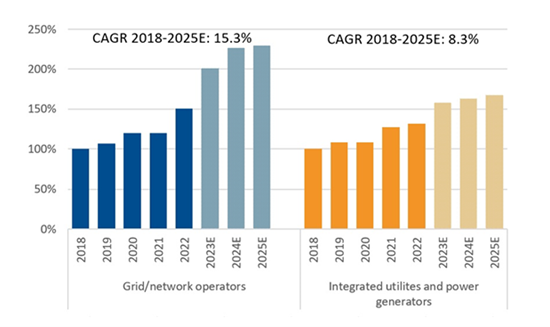

Aggregated capex for the 33 European power utilities, excluding grid operators, that we rate will increase at a compound annual growth rate (CAGR) of 8.4% in 2022-2025, rising to EUR 81.6bn in 2025 from EUR 75.9bn this year and EUR 75.6bn in 2023. This growth is in line with that in 2018-2025 (Figure 5).

Figure 5: Supercharged: European utilities’ capex runs at faster rhythm (2018-25E)

Capex indexed, 2018 = 100

Sources: Companies, Bloomberg consensus,

Scope Ratings estimates

In contrast, for the 19 European grid operators in our coverage, the three-year CAGR 2022-25 will run at a much higher rate of 15.2%. This represents a remarkable step up from the average of 12.6% for the longer period of 2018-2025.

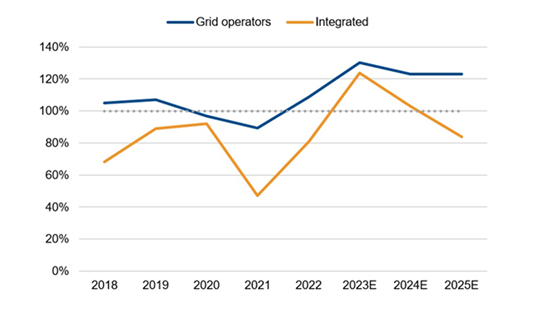

Grid operators are increasingly turning to external funding to meet this capex challenge given their operating cash flow is insufficient to cover their capex requirements in contrast with integrated utilities (Figure 6).

Figure 6: Capex/operating cash flow of 53 covered entities (%)

Source: Scope Ratings estimates

Companies adapt to meet capex challenge, preserve credit quality

Mounting capex puts persistent pressures on utilities’ free operating cash flow and external funding, as well as leverage and interest coverage, but Europe’s utilities are adapting.

First, utilities are largely managing shareholder expectations on shareholder remuneration by balancing short-term shareholder pain through modest dividend distribution during the transition phase with the promise of medium-to long-term gains with the creation of more sustainable business models.

Secondly, asset rotation or optimisation remains an important source of external funding with the least possible detrimental effect for consolidated EBITDA and operating cash flows.

Thirdly, utilities remain among the most frequent users of hybrid debt for which the advantage of the securities’ equity component for the purposes of calculating debt leverage is usually greater than the disadvantage of paying higher coupons compared with conventional bonds.

Lastly, utilities retain ready access to market funding given the clear objectives for which they are raising debt, unlike some other sectors disrupted by the abrupt shift in the interest cycle in the past couple of years.

Consequently, while many utilities are expected to report little or even negative free operating cash flows, which would worsen leverage and credit profiles, downward ratings pressure overall is limited. The sector on average should maintain its leverage multiples, measured by Scope-adjusted debt/EBITDA: between 2x and 4x for integrated utilities and power generators and between 4x and 6x for regulated grid/network operators will remain solid commensurate with existing rating levels or even provide further upside if sustained in the context of power generators.

Higher interest costs look largely absorbable by capital-intensive sector

Mounting capex and the need for more external funding – particularly for grid/network operators – puts pressure on debt protection metrics such as interest coverage particularly when interest rates have risen and are likely to remain high. Higher interest paired with inflated construction costs can also threaten the economic viability of some power projects, as we have seen most notably with cancellations of plans to build offshore wind installations.

However, higher interest rates do not pose a broader threat to the utilities sector’s credit quality. First, utilities tend to use fixed-rated debt, with the exception being among Nordic utilities for which exposures to floating-rate debt can run up to 20%. The result is that interest cost increases pertaining to floating rate debt, refinancing and new debt-funded investment have only a gradual impact on credit metrics.

Secondly, regulated grid/network operators are largely beneficiaries of rising interest rates as regulated tariffs will increase over time to reflect the rise in the cost of capital, feeding through to higher profit margins and operating cash flow. Higher tariffs will thereby support capex and interest coverage, reversing the pressure on ratings during the long period of ultra-low interest rates, which hit network/grid operators’ profitability.

Lastly, higher interest payments are going to be offset by higher operating earnings from existing and new investment, providing little long-term pressure on interest coverage. Consequently, integrated utilities and power generators will benefit from solid average interest cover of more than 10x. For network/grid operators, the average ratio will range from 7x to 10x.

To download the full Corporates Outlook 2024, please follow this link.

Webinar: Tuesday, 20 February at 15:30 CET

Please join Scope Ratings analysts for an in-depth discussion of the European corporate credit outlook for 2024 by registering here.

Make sure you stay up to date with all Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds.